Pennsylvania 2045 Long-Range Transportation Plan

Message from the Secretary

Transportation is critical to Pennsylvania's economic vitality and well-being. We see that theme across history, and it holds true today in a time of transformative change. Now, enabled by technology and driven by data, the Commonwealth's transportation system can become more efficient, responsive, sustainable, resilient, and equitable than ever before.

Pennsylvania's 2045 Long-Range Transportation Plan (LRTP) outlines a future transportation system that Pennsylvanians are creating together.

Transportation agencies provide facilities and services essential to everyday life. As such, we must be able to react effectively to abrupt changes and urgent situations, such as those thrust upon us by the COVID-19 pandemic and the relentless impacts of climate change. The Pennsylvania Department of Transportation (PennDOT) makes investments in roadways, bridges, public transit, and other infrastructure that last decades, and must do so with a strategic future perspective that considers big-picture outcomes for the Commonwealth's transportation system and its users.

The plan's goals are inspiring and were developed based on broad engagement with diverse stakeholders, the public, and underrepresented interests, which is the cornerstone of the planning process. This resulted in wide-ranging and valuable feedback, so much so that a major goal and objectives specific to addressing equity are a key part of the LRTP.

Our ability to achieve these goals—even with the extensive collaboration with our partners and stakeholders—depends upon securing adequate resources. Implementing strong investment proposals like that put forward by the Transportation Revenue Options Commission1 will be essential for advancing much of this plan.

Under any funding scenario, collaborating with other agencies, other levels of government, the private sector, MPOs/RPOs, and the public is vital to making positive, systemwide improvements. I am pleased with the diverse engagement that has occurred with such partners, with the aim of collaborative implementation to accomplish common purposes.

Transportation is about fostering opportunity. We must make wise investments in our infrastructure and services that yield great returns, opening opportunities for all Pennsylvanians. As stewards of the statewide transportation system, that mindset is at the heart of this plan and our commitment to implementing its strategic actions and initiatives. We are embracing new tools, skills, processes, and perspectives to accomplish this plan.

A special thank you to the many individuals who provided input during the plan's development. We ask that all Pennsylvanians remain involved as we implement the plan's action strategies and initiatives that will strengthen our transportation system, programs, and services long into the future.

LRTP Strategic Directions Summary

The plan's six goals and objectives are listed below.

- Safety

- Enhance safety and security for both motorized and non-motorized modes throughout Pennsylvania's transportation system.

- Continue to promote behavioral change through existing educational initiatives with partners and stakeholders that encourage safe habits for users of all modes.

- Reduce the rate and frequency of fatal and serious injury crashes for all modes of travel.

- Expand the collection of transportation safety data and explore funding sources for safety and data analysis for use in systemwide planning, programming, project development, and project delivery.

- Strengthen security across transportation modes in collaboration with public and private stakeholders.

- Mobility

- Strengthen transportation mobility to meet the increasingly dynamic needs of Pennsylvania residents, businesses, and visitors.

- Continue to improve system efficiency and reliability.

- Continue to improve public transportation awareness, access, and services throughout Pennsylvania.

- Provide and prioritize multimodal transportation choices to meet user needs, expand mobility options, and increase multimodal system capacity and connectivity.

- Implement regional transportation, land use standards, and tools that result in improved multimodal coordination and complementary development.

- Adapt to changing travel demands, including those associated with e-commerce and post-COVID-19 pandemic changes.

- Work with private sector partners to establish data standards for mobility services and their applications (e.g., Uber and Lyft, carsharing services, bikeshares, etc.)

- Equity

- Improve transportation access and equity throughout Pennsylvania.

- Evaluate transportation equity issues and opportunities across Pennsylvania.

- Develop measurable goals and metrics for equitable transportation in collaboration with key stakeholder groups.

- Establish equity and access strategies in partnership with stakeholder organizations

- and groups that advance the identified measurable goals.

- Improve equity and accessibility through ADA improvements and modal choice.

- Develop education, awareness, and training initiatives that strengthen transportation professionals' knowledge and skills to effectively address equity issues and opportunities.

- Implement and support public transportation initiatives for affordability, reliability, and availability for the transit-dependent population.

- Resilience

- Strengthen Pennsylvania transportation's resilience to climate change and other risks and reduce transportation's environmental impacts.

- Employ resiliency measures/actions to ensure long-term system stability.

- Evaluate projects for their expected climate change and resiliency impact and implications

- Improve environmental stewardship during and before project construction.

- Performance

- Improve the condition and performance of transportation assets.

- Leverage technology, operations enhancements, and skill building to improve transportation system efficiency.

- Continue to integrate enhanced asset management approaches and methods with project planning and programming.

- Enhance the availability and quality of real-time travel information, especially in emergency and inclement weather events and for construction/work zones.

- Expand and/or build upon existing technical assistance and education to local communities and MPOs/RPOs.

- Identify potential new public transportation performance measures including value-based, quality-of-life measures demonstrating the difference public transportation makes in the lives of people, including access to employment.

- Resources

- Structure transportation funding and finance approaches that allocate sufficient resources for system safety, maintenance, preservation, and improvement.

- Advance a multimodal and state-local funding strategy to ensure that resource levels are sufficient to meet transportation system needs.

- Adapt to and position for accelerating change (e.g., mainstreaming innovation, institutional adjustments, people skills, and knowledge management).

- Streamline planning and public involvement processes.

- Improve planning and analytical tools to adapt to changes impacting transportation, including the implementation of a data repository and information exchanges within PennDOT (between Bureaus/Divisions, between Central Office and Districts, etc.).

Transportation Planning in 2020 and Beyond

Development of the 2045 Long Range Transportation Plan (LRTP) and Freight Movement Plan (FMP) began in 2019. In early 2020, the entire nation experienced a period of disruptive change beginning with the onset of the COVID-19 Pandemic.

Transportation planning for both the short- and long-term was forced to accommodate these changes as the demand for a safe, efficient and reliable transportation system became essential to all citizens in Pennsylvania as well as across the nation.

In late 2021, federal legislation was passed to address the investment need in the nation's infrastructure. PennDOT and its partners are working diligently to assign these dollars to projects across the Commonwealth. There has also been significant advances in vehicle electrification technology with ambitious goals for widespread adoption as well as ongoing advancements in artificial intelligence, robotics, and related transformative technologies.

With transportation conditions and needs changing so rapidly, what is the value of a long-range plan, and how do we keep it relevant when we can't see over the horizon?

Long-Range Goals for Continuity

Long-range transportation planning is especially valuable because of rapid near-term change. Instead of merely reacting and constantly changing course, adhering to a consistent long-term vision enables systematic progress. This is especially true given the multi-year nature of transportation project development, from planning through design and construction to ongoing maintenance.

The goals associated with the LRTP articulate what aspects of transportation are important to Pennsylvanians, and what broad types of outcomes are desired over the 20-year planning horizon. For example, safety will always be a priority, even though advances in automated vehicles may change PennDOT's activities toward enhancing transportation safety.

Near-Term Actions for Adaptation

Although the LRTP is based on rigorous analysis of trends and likely future conditions, no doubt new issues and influences will arise over the coming years. This reality is accommodated by the implementation approach. PennDOT's LRTP Action Plan—which identifies, schedules, and tracks individual tasks that will advance the plan's goals and objectives over the next five years—will be monitored and modified as appropriate to ensure that activity is strategically adapted to address changing needs and opportunities.

The LRTP is considered a “living document” to be adjusted as conditions warrant, with the aim of ensuring that Pennsylvania mobility is poised to meet dynamic needs for decades to come.

Table of Contents

Context: What, Why, How, and Who

- Long-Range Transportation Plan Essentials

- Public & Stakeholder Involvement

- Public Comment Period

Existing Conditions and Trends: Where We Are Now

- Highlights by Mode

- Additional Opportunities

Strategic Directions: Where We Need to Be

- Goals and Objectives

Implementation: How We Will Get There

- Overview

- Actions and Accountability

- Implementation Partners and Projects

- Transportation Performance Management

- Implementation Resource: Transportation Planning Data Repository

Context: What, Why, How, and Who

Long-Range Transportation Plan Essentials

The statewide long-range transportation plan (LRTP) establishes a direction for Pennsylvania's transportation system, for across a 20-year planning horizon. That direction is expressed as the goals and objectives that will guide our programs and project investments.

This 2045 PA LRTP has been developed alongside a PA Freight Movement Plan (FMP). The two plans complement each other, establishing a comprehensive direction for enhancing the movement of people and goods within and through the state.

The statewide LRTP does not include specific projects, such as bridge replacements or major road improvements. These projects are developed regionally by the state's metropolitan and rural planning organizations (MPOs/RPOs), known as PennDOT's Planning Partners. Each MPO/RPO develops a regional LRTP in step with the statewide direction. See Figure 26 for a map of Pennsylvania's MPO/RPO regions.

LRTP Elements:

- Interstate Highway System

- Non-Interstate Roadway Network

- Bridges

- Traffic Operations

- Freight

- Public Transportation

- Passenger Rail

- Active Transportation

- Aviation

- Connected and Automated Vehicles (CAV)

PennDOT produces modal and functional plans that relate to the LRTP, including:

- Active Transportation Plan

- Aviation System Plan

- Freight Movement Plan

- State Rail Plan

- Strategic Highway Safety Plan

- Regional Operations Plans

More background on Pennsylvania Transportation planning - history and process - is provided in Appendix A, available at: penndot.gov/planning.

Transportation Planning Process

Long-range planning is one of three key phases of transportation improvement. Plans guide development of Transportation Improvement Programs (TIP) established at the regional level. The TIP projects are rolled up into a Statewide Transportation Improvement Program (or STIP) and included in the statewide 12-Year Program (TYP), which is updated every two years.

In the off-year, the State Transportation Commission (STC) and Transportation Advisory Committee (TAC) compile a Transportation Performance Report (TPR), which serves as a report card on the transportation system and helps direct future programming to achieve plan goals. It is a cornerstone of the TYP development process.

The update of both the LRTP and 12-Year Program include extensive outreach to the public and transportation stakeholders to ensure that public perspectives are considered as part of the process.

Planning: Sets Direction

- Long-Range Transportation Plan (LRTP) 20-Year Plan (Updated every 6-10 years)

- Where do we want to go?

- Goals

- Objectives

- Measures

- How are we going to get there?

- Implementation Strategies

- Policies

- Priorities

- Functional Plans

- MPO/RPO LRTPs

Programming: Prioritizes Projects

- 12-Year Program (TYP)

- How can we best use available funding?

- Lists funded projects for a 12-year period

- First four-year period is the Statewide Transportation Improvement Program (STIP)

- STIP complies MPO/RPO Transportation Improvement Programs (TIP)

Performance Measurement: Measures Progress

Public & Stakeholder Involvement

Many voices throughout the Commonwealth provided the foundation for effective development and successful implementation of Pennsylvania's 2045 LRTP. The scope and scale of outreach conducted for the LRTP was greater than for any previous plan. The users of the statewide transportation network provide an essential perspective in helping to shape the plan's strategic directions.

To capture transportation system needs and concerns across Pennsylvania, input was solicited in various forums and incorporated at key points during plan development. In addition to statewide public outreach and stakeholder engagement, extensive “in-reach” was a key element of the stakeholder engagement process. PennDOT units and partnering agencies and organizations were engaged to ensure that current and future initiatives would be properly reflected and supported by the LRTP's implementation plan.

Engagement Highlights

Public Outreach

- Public Surveys Completed: 7,400

- Public Forum Views: 1,905

- E-News Contacts: 2,700

- Social Media Posts: 11

Stakeholder Engagement

- MPOs and RPOs Engaged: 24

- State Transportation Commission & Transportation Advisory Committee Presentations: 8

- Freight Focus Group Meetings by Mode: 5

- Freight Forum Registrations: 225

- Equity & Diversity Workshops Attendance: 25

- PennDOT Planning Network e-Blasts: 9

- State Planning Board Attendance: 49

PennDOT In-reach & Interagency Collaboration

- Executive Interviews: 35

- PennDOT Bureaus/Districts Engaged: >40

- Partnering Agency Interviews & Presentations: 5

Public Comment Period

Public & Stakeholder Involvement

The success and implementation of the LRTP strongly depends on public and stakeholder involvement and participation. Feedback was requested on the draft plans through the Public Comment Period from September 20 – October 19, 2021.

Significant effort was made to maximize public outreach during the comment period, through social media, email campaigns and targeting underserved populations such as senior citizens, people with disabilities, and marginalized communities. Additional measures were taken to bridge the digital divide in rural communities across the state by having Pennsylvania public libraries serve as access points to the digital and printed plans for review and comment. Opportunity for feedback was also given to Federally Recognized Tribes to better understand how the plans will impact their community now and in the future.

Public Comment Period Outreach by the Numbers

Social Media

Significant effort was made to maximize public outreach and awareness during the comment period through Facebook, Twitter, Instagram, and LinkedIn. Targeted social media posts were used to reach underserved populations such as senior citizens, people with disabilities, and marginalized communities.

Total Posts: 7

Reach*: 183,392

Impressions*: 287,733

Engagement*: 26,436

Stakeholder Email Campaign

Internal and external stakeholders were engaged through several email newsletters sent by PennDOT Planning Network eNews.

Emails Sent: 6

Stakeholder Database: 8,083

Average Open Rate: 32.6%

New Newsletter Sign-ups: 53

Public Comment Period Website

The Public Comment Period website was made available for public review on the PennDOT Planning and Talk PA Transportation websites. The plans were also made available in PDF and text-only formats and accompanied by comment forms for public to use to provide their feedback.

Total Page Views: 2,230

Public Library Access

Additional measures were taken to bridge the digital gap in rural communities statewide by having Pennsylvania public libraries serve as access points to the digital and printed plans for review and comment.

Libraries received printed copies of the plans: 618

Post-Comment Period Survey to Public Libraries: 42

Tribal Outreach

Opportunity for feedback was also offered to Federally Recognized Tribes with ancestral ties to Pennsylvania to better understand how the plans will impact their community now and in the future.

17 Federally Recognized Tribes received hard copies of the plans and links to the digital versions.

*Social Media Definitions

- Reach is the number of people who saw any content from the PennDOT page or about the PennDOT page.

- Impressions are the number of times any content from PennDOT or about PennDOT entered a person's screen.

- Engagement is any action someone takes on PennDOT's page or one of PennDOT's posts.

Statewide Virtual Freight Forum

A major milestone for the stakeholder engagement process was the Statewide Virtual Freight Forum. It convened over 175 stakeholders from across the state and nation to discuss the dynamics of the freight industry, explore current trends, and offer feedback on a recommended future direction.

Key themes emerging from the forum were:

- Freight networks are critically important to the supply chain which moves essential raw materials as well as finished goods.

- Issues such as truck parking will become more challenging as our reliance on goods movement continues to grow.

- Trending issues such as automated vehicles, the explosive growth of e-commerce, and changing supply-chain patterns are poised to affect our planning.

- It is imperative to reduce the impact of transportation on our changing climate.

- We must abide by the value of fairness in working to meet the transportation needs of all our communities and citizens.

Executive Interviews: Key Themes

Several common themes emerged from interviews of agency executives at the start of the planning process, including:

- Transportation and land use connection

- Emerging technology

- Asset management

- Equitable solutions for diverse populations, from urban to rural areas

- Multimodal and intermodal connections

- Transportation's impact on quality of life

- Stronger connections between planning and programming

- Funding to support plan outcomes

- Implementation and accountability

Municipal Collaboration

The following organizations offered local government viewpoints during statewide plan development:

- Pennsylvania State Association of Boroughs (representing 956 boroughs, statewide)

- County Commissioners Association of Pennsylvania (67 counties)

- Pennsylvania State Association of Township Supervisors (1,546 townships)

- Pennsylvania Municipal League (119 members)

- Pennsylvania State Association of Township Commissioners (93 first class townships)

STC TYP Public Survey

Public feedback was obtained through an online public survey and public forum hosted by PennDOT and the STC for the 2023 12-Year Program update. Extensive outreach and promotions were launched through the STC website, including e-mail blasts to thousands of stakeholders, a targeted social media campaign offered in Spanish and Mandarin—the two most-spoken languages in Pennsylvania after English, traditional media outreach, and outreach in partnership with stakeholders.

PennDOT will continue to use the STC online public survey process to inform the 12-Year Program and future LRTP updates. Future surveys will include recurring questions (to draw important comparisons and trends, over time) as well as new questions to obtain the public's opinions on Pennsylvania's changing transportation conditions.

Survey Results: Transportation Priorities

7,400 respondents completed a public survey and ranked their transportation priorities in the following order:

- Road Pavement: Repairing, restoring, reconstructing, and maintaining state and local roads

- Bridges: Repairing, replacing, and maintaining state and local bridges

- Traffic Flow: Adding new lanes, constructing new roads, and using technology to improve traffic flow

- Interstate Highways: Prioritizing Interstate reconstruction investments with numerous specific projects identified

- Walking: Accessible and connected walking routes

- Public Transportation: Accessible and frequent public transportation options that cover an extensive service area and cross regions

- Passenger Rail: Intercity and commuter rail service with out-of-state connections

- Bicycling: Safe routes and facilities throughout the state

- Freight: Modern highways, railways, airports, and ports to support the economy

- Aviation: Modern facilities, operations, and a wide range of commercial airline choices

Existing Conditions and Trends:

Where We are Now

Demographics

Trends & Issues

- With a 2020 population of just over 13 million, Pennsylvania remains one of the most populous states in the nation, ranking fifth in size. Pennsylvania's economy, were it a single country, would be the 25th-largest in the world, just behind Belgium and Taiwan.

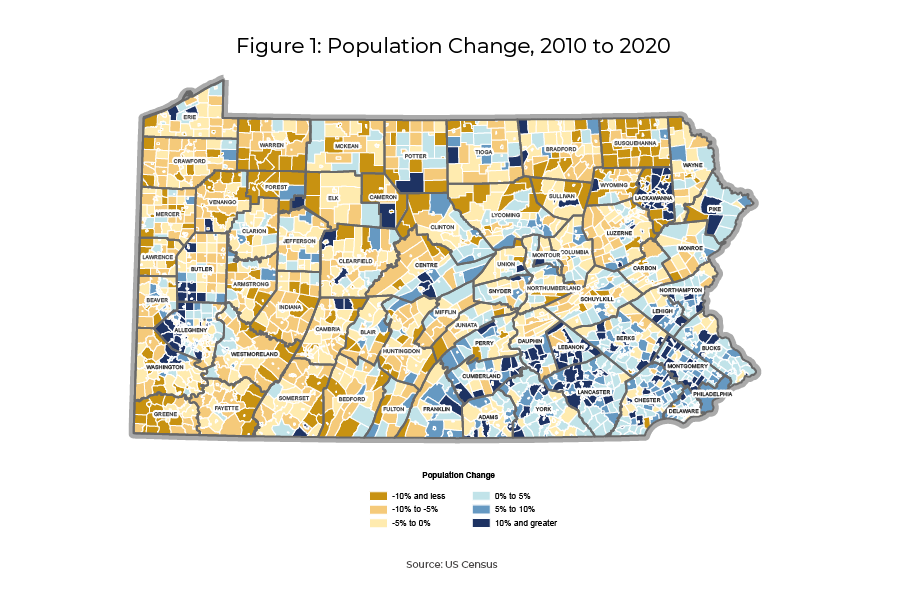

- Most of Pennsylvania's population growth has occurred within its southeastern (Philadelphia) and southcentral (Harrisburg) regions. Cumberland and Lebanon counties have led the state in growth rates since 2010, while Philadelphia, Montgomery, and Lancaster counties experienced the greatest population gains numerically (Figure 1).

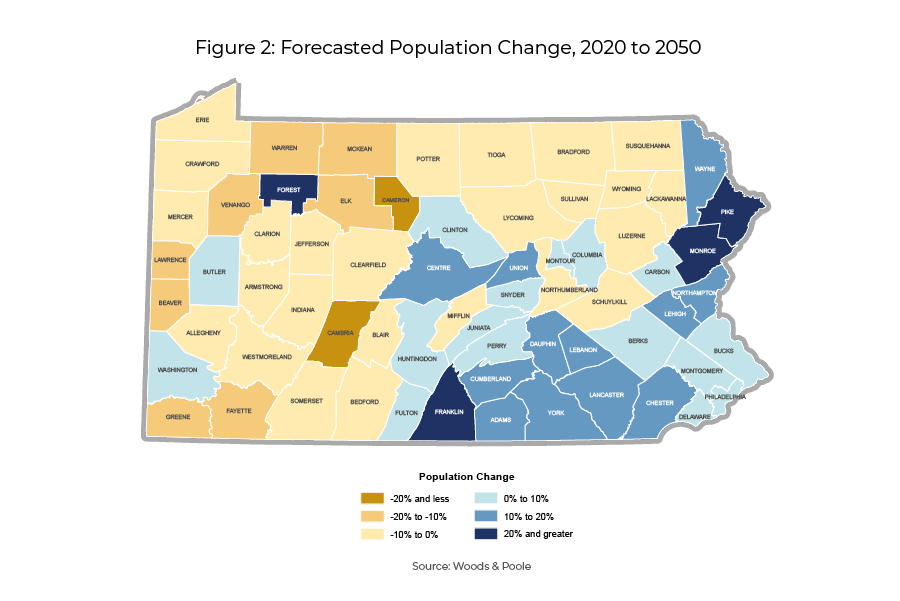

- Pennsylvania's growth rate since the 2010 U.S. Census (2.4 percent) is well below the national average (7.4 percent). Among the 50 states, Pennsylvania ranked 44th in rate of population growth since 2010. By 2050, the state's population is forecasted to exceed 13.3 million (Figure 2).

- Of Pennsylvania's 67 counties, 46 had population declines over the past decade, with the steepest losses occurring in the western counties of Cambria, Erie, and Westmoreland.

- Growth in the state's townships continues to far outpace that of more densely populated cities and boroughs. Roughly 56 percent of the state's population resides in one of the state's 1,546 townships.

- Pennsylvania has one of the nation's largest populations of rural residents. Just over a quarter of the state's residents (3.5 million as of 2021) live in one of the state's 48 rural counties.

- Every day, an estimated 500 Pennsylvania residents turn 65. By 2030 all Baby Boomers (those born between 1946 and 1964) will be age 65 or older, comprising 23 percent of the state's population (compared to just 15 percent in 2010). This share is expected to remain steady through 2050 due to mortality rates.

- Millennials, or those born between 1981 and 1996, now outnumber Baby Boomers and are Pennsylvania's largest demographic group. This technology-driven generation came of age during the rise of the Internet and is more accepting of technology and technological change than previous generations.

- Pennsylvania is also more racially diverse. By 2050, the state's non-white population is expected to increase 13 percent, while the white population is expected to decline by the same rate. Pennsylvania's youth are more diverse than the state's adult population (age 20 and older).

Planning Implications

- Despite being a “slow growth” state, Pennsylvania is a large consumer market in the Northeastern U.S., with strong demand for travel by people and freight on its transportation system. Ongoing changes in demographics will affect where and how transportation infrastructure and services must adapt to accommodate demand. Serving the mobility and access needs of urban and rural residents and businesses will continue to be an important challenge.

- The confluence of a growing number of older Pennsylvanians, coupled with a greater desire of Millennials and Generation Z (born between 1997 and 2012) for good connections to community destinations, affordable homes, and mixed-use development sites with residences, workplaces, shopping, and restaurants in close proximity, means that local communities will need to place a greater emphasis on walkability, and micromobility, and adopt zoning that encourages and helps facilitate multimodal approaches to address transportation needs.

- Technology continues to change at an accelerating rate, and at a pace that has been further propelled by the COVID-19 pandemic (e.g., home package delivery). The “creative disruption” of the pandemic spurred the adoption of technology, particularly by younger generations, and will continue to fuel an ongoing evolution in the development of connected and automated vehicles, embrace of e-commerce, and interest in “smart city” projects.

Figure 1: Population Change, 2010 to 2020

Figure 1 illustrates data from the U.S. Census in a map of Pennsylvania color-coded to depict the percentage of population change in municipalities across the state between 2010 and 2020.

Figure 2: Forecasted Population Change, 2020 to 2050

Figure 2 illustrates data from Woods & Poole in a map of Pennsylvania showing counties color-coded to depict the forecasted population change by percentage between 2020 and 2050.

Interstate Highway System

Trends & Issues

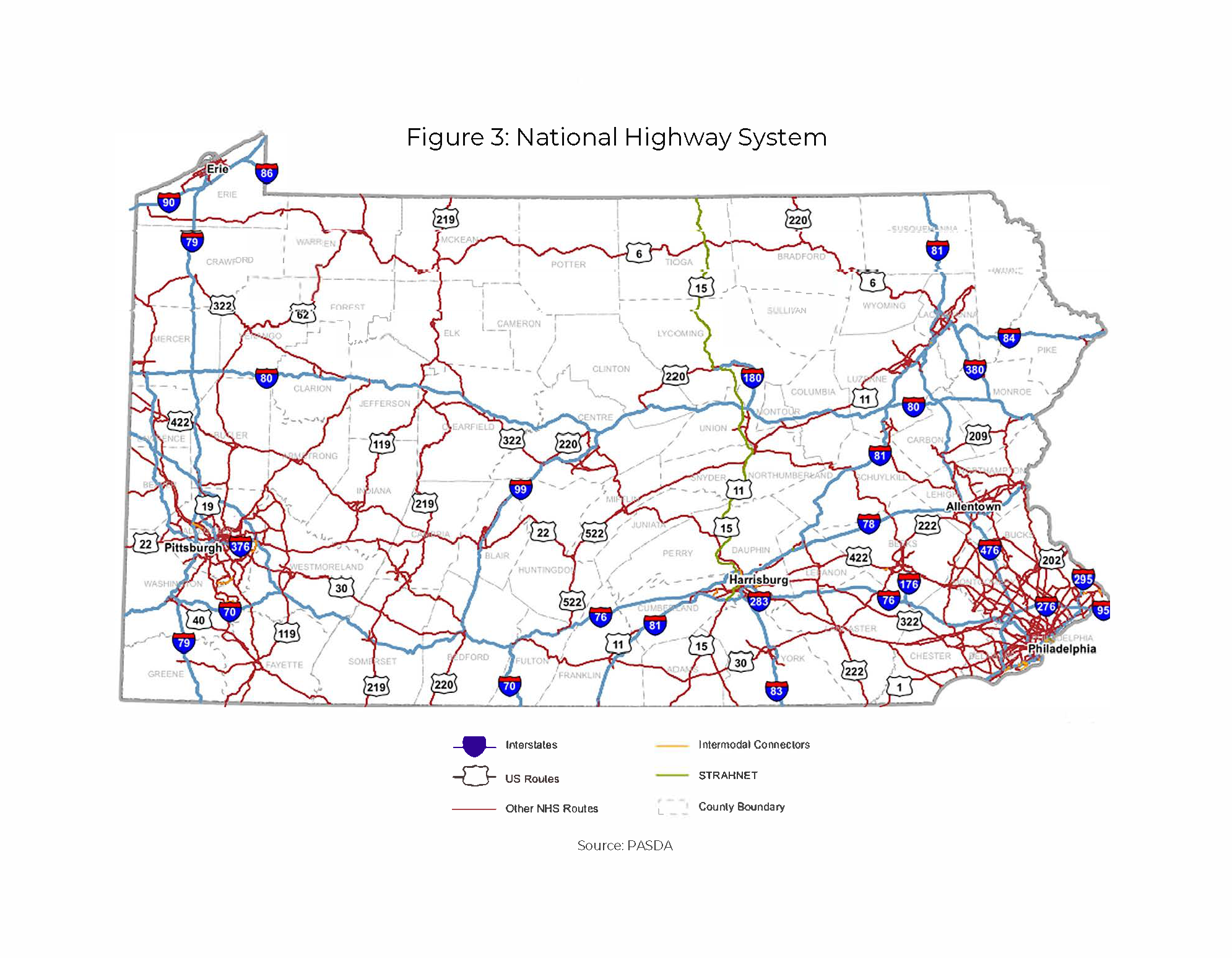

- Pennsylvania is served by 1,870 linear miles of Interstate highway—the fourth-largest network of Interstates in the nation (Figure 3).

- Interstates comprise only 6 percent of total state-owned roadway mileage yet accommodate 24 percent of all traffic volume. Moreover, these highways account for only 12 percent of total crashes (2019).

- Interstates registered 44 percent of all of Pennsylvania's work zone fatalities in 2019.

- Much of Pennsylvania's Interstate system was constructed more than 50 years ago and needs major rehabilitation or replacement.

- Further, much of the Interstate system will be over 80 years old at the end of the LRTP horizon year of 2045. Pavement reconstruction efforts are insufficient due to funding constraints, adding to the backlog of needs. Interstate funding in general has remained relatively flat since 2007 (Figure 4).

- Following federal asset management requirements, PennDOT has adjusted its programming philosophy to make greater levels of investment in the Interstate system. From a present-day level of approximately $450 million annually, funding is expected to grow to $1 billion by 2028. The level of Interstate funding has remained relatively constant since 2007 (Figure 4).

- While program planning for the Interstates was originally carried out regionally by MPOs and RPOs, PennDOT centralized planning functions for the Interstates in 2007 so they could be addressed as one strategic asset. PennDOT formed an Interstate Steering Committee (ISC) in 2015 to oversee the Interstate Management Program. The ISC includes representation from PennDOT's Center for Program Development and Management (CPDM), Bureau of Maintenance and Operations (BOMO), Bureau of Project Delivery (BPD), and the 11 PennDOT Engineering Districts.

- The ISC is currently documenting its decision-making processes as the means to review and potentially improve the procedures for project prioritization.

- MAP-21 and the FAST Act1 established Performance-Based Planning & Programming (PBPP) and Transportation Asset Management Plan (TAMP) requirements. These requirements are driving PennDOT to move toward Lowest Life- Cycle Cost asset management approaches, which prioritize timely repairs versus fixing the worst infrastructure first. PennDOT completed its current TAMP in June 2019.

Figure 3: Pennsylvania Interstate Highway System

Figure 3 is a state map from PASDA of Pennsylvania illustrating the 1,870 miles of interstate highway network miles and the Pennsylvania Turnpike.

Figure 4: Pennsylvania Interstate Funding History (Millions $)

.png)

Figure 4, a bar chart, illustrates Pennsylvania's interstate funding history from Federal and State sources from 2007 through 2020 from PennDOT's data.

1 Federal transportation legislation, respectively Moving Ahead for Progress in the 21st century and Fixing America's Surface Transportation Act.

Planning Implications

- The improvement needs of Pennsylvania's Interstate system are far greater than the funding available. Even with the projected ramp-up in funding to $1 billion annually by 2028, the state will continue to fall short of what is needed to keep the system in a state of good repair. It is estimated that $1.2 billion is needed per year to address cyclical asset management needs on the Interstate system. Increased funding will be needed for:

- The current backlog of assets needing improvement

- Modernization (fiber network, intelligent transportation system (ITS) expansion, operational improvements, safety and guiderail upgrades, all-weather pavement markings)

- Strategic Investments – selected capacity improvements, interchanges, truck climbing lanes

- The Secretary's Discretionary Funding on the Interstate system allows projects to advance that are vitally important to maintaining and improving Interstate infrastructure.

- P3 (Public-Private Partnership) project delivery is a tool that can augment resources for the Interstate program.

- PennDOT's Freight Investment Plan (FIP) is a multi-year, fiscally-constrained listing of projects to improve conditions on Interstates using funding from the National Highway Freight Program (NHFP). Pennsylvania currently receives over $61 million annually for the FIP, which is a key input to the TYP. FIP projects are focused on I-95 and several other interstates over the next decade.

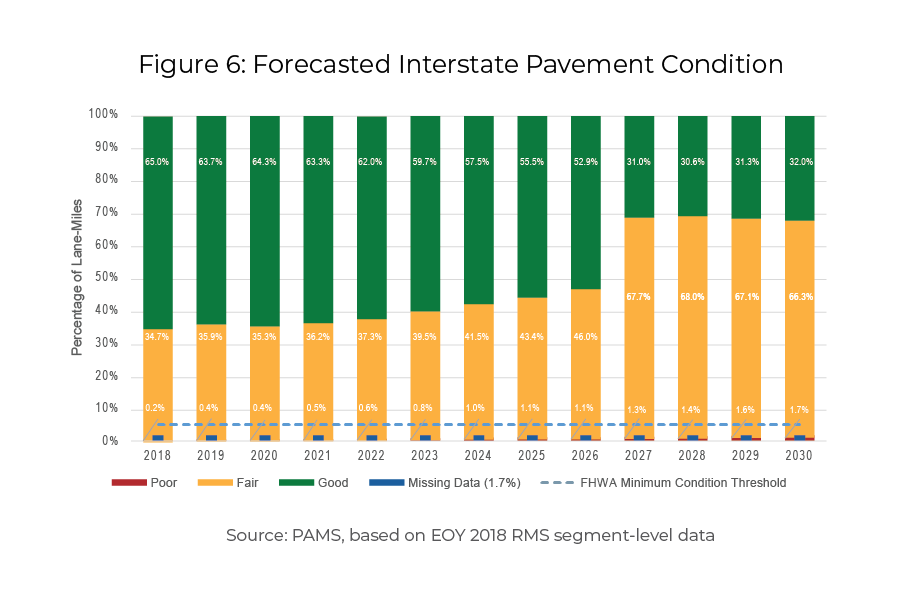

- Interstate maintenance and related improvements are currently funded at only half the level necessary to keep with a desired preventive maintenance cycle. Further, by having to direct more funds to the Interstate program, resources are diverted from the rest of PennDOT's road and bridge network (Figures 5 and 6).

Figure 5: Forecasted Interstate Bridge Condition (by Deck Area)

Figure 5, a bar chart, illustrates the forecasted bridge conditions by poor, fair, or good condition from 2019 through 2030 based on BAMS, EOY 2018 BMS2 data.

Figure 6: Forecasted Interstate Pavement Condition

Figure 6, a bar chart, illustrates the forecasted interstate pavement condition by the percentage of lane-miles rated by poor, fair, and good. The chart also includes FHWA's Minimum Condition Threshold and a notation that 1.7% of data is missing. The data is from PAMS based on EOY 2018 RMS segment-level data.

Pennsylvania is served by 1,870 linear miles of Interstate – the Fourth-largest network of Interstates in the nation.

Non-Interstate Roadway Network

Trends & Issues

- Pennsylvania has a large and aging network of roadways. There are more than 120,000 linear miles of roadway in Pennsylvania—nearly 40,000 of which are owned, maintained, and operated by PennDOT; the rest of the extensive road network is primarily owned and maintained by local government.

- The extensive improvement needs for improving the local system of roads and bridges is also a major problem that was also discussed was addressed in the TROC funding proposal.

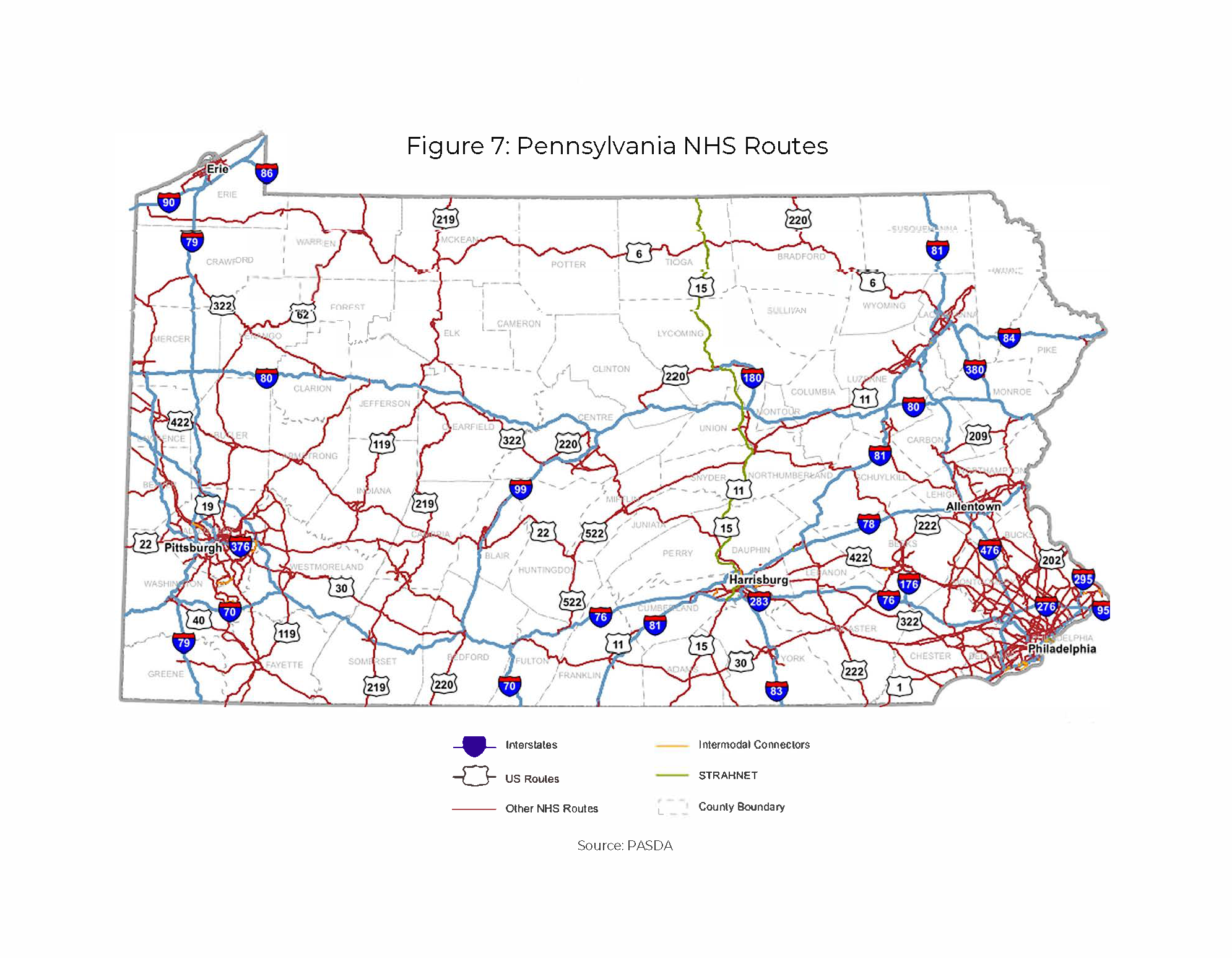

- Roadways are the backbone of Pennsylvania's transportation system, particularly in its more rural areas where National Highway System routes provide essential access (Figure 7).

- The state's roadway network accommodates approximately 281.5 million miles of travel, daily. Total demand for travel has remained relatively constant over the past decade.

- For planning and programming purposes, PennDOT has organized its highways into four Business Plan Network (BPN) classifications, including:

- National Highway System (NHS) Interstate (BPN 1)

- NHS Non-Interstate (BPN 2)

- Non-NHS with Average Daily Traffic (ADT) > 2,000 (BPN 3)

- Non-NHS with ADT < 2,000 (BPN 4)

- The Federal Highway Administration (FHWA) in February 2019 certified 423.79 miles of roadway as Critical Urban and Critical Rural Freight Corridors (CUFCs and CRFCs), making them eligible for National Multimodal Freight Network (NMFN) funding.

Figure 7: Pennsylvania NHS Routes

Figure 7 is a PASDA state map of Pennsylvania illustrating the National Highway System Routes, Interstates, US Routes, and county boundaries.

Planning Implications

- PennDOT is moving away from prioritizing roadway improvements from a “worst-first” approach in favor of a “lowest life-cycle cost” method. This approach is aimed at making timely improvements when needed to extend roadway life. Lowest life-cycle cost places greater emphasis on timely maintenance for system preservation. Lowest life-cycle cost as a strategic approach is especially important given the need to stretch limited resources.

- The extensive investment needed for system maintenance has resulted in fewer capacity-adding projects. Nonetheless, PennDOT is moving forward on several major roadway projects, including: the US 322 widening in Delaware County and the Central Susquehanna Valley Transportation (CSVT) project in Northumberland, Snyder, and Union counties.

- FHWA's November 2017 approval of Pennsylvania's first statewide freight plan pre-dated the certification of CUFCs and CRFCs. PennDOT will need to collaborate with the state's MPOs and RPOs on CUFC and CRFC designations as shipping patterns and demand changes. Use of PennDOT's forthcoming transportation planning data repository will be a useful resource as part of this initiative.

- Funding is inadequate to keep pace with rehabilitation and replacement projects needed to keep the system in optimal condition. Moreover, the increased age of Pennsylvania's roads and bridges minimizes the benefit of continual preservation treatments. As documented in the TROC Final Report, PennDOT's $8.8 billion annual budget must more than double—to approximately $18.15 billion—to adequately address transportation system needs.

- As population and industry continually shift in location and density across Pennsylvania, changes in land use patterns should be monitored to plan for potential shifts in highway and bridge needs.

- Continued coordination between county planning agencies and MPO/RPO officials will help to ensure that highway and bridge needs are clearly articulated in county comprehensive plans—fostering a needed transportation and land use connection.

- Local governments, through comprehensive plans, zoning, and subdivision and land development ordinances, can promote a mix of uses to encourage fewer private motor vehicle trips, reducing pressure on the existing highway and bridge network. Municipal adoption of access management ordinances can also ensure land use changes consider efficient transportation ingress/egress for new developments.

- With the continued rise in e-commerce, and freight activity in general, there is an increased need to store and deliver consumer goods. This has resulted in the expansion of warehouse and distribution facilities, particularly in the state's eastern and central regions. Communities should continue to plan in ways that take these transportation-intensive uses into account as early as possible rather than having to react, which also forces costly transportation improvements. Present resource constraint, if not addressed with additional funding, will make it increasingly difficult to “follow” such developments with the supporting transportation infrastructure.

- Due to the COVID-19 pandemic, county and local government leaders should begin to assess how community land uses might change, impacting the highway network. The pandemic accelerated trends such as e-commerce, the movement away from denser urban cores to single-family homes in suburban and rural areas, rising vehicle ownership, and increasing demand for bicycle and pedestrian infrastructure.

- The present funding shortfall poses a dilemma that must soon be resolved. As greatly limited resources are prioritized to the Interstate system to the greatest extent possible, other roads and bridges receive even less funding. This trade-off is untenable and unsustainable. A level of sufficient investment must be established to ensure that non-Interstate roads and bridges do not fall into an overall state of disrepair.

- With uncertainties over future funding levels and a substantial reduction in purchasing power, funding gaps continue to increase.

- To help address funding shortfalls, counties and local governments can continue to plan and zone for land use that leverages existing transportation assets and enables use of active transportation options. This will reduce the need for new highway and bridge infrastructure, helping to manage transportation costs.

- Further, local governments will likely need to make greater use of tools such as impact fees, transportation development districts, or developer agreements to help fund new highway and bridge construction.

- There are great challenges in using these tools, which are best suited to areas that are growing. For most areas of Pennsylvania that have stable or declining population growth and little non-residential development, the use of these tools is not practical.

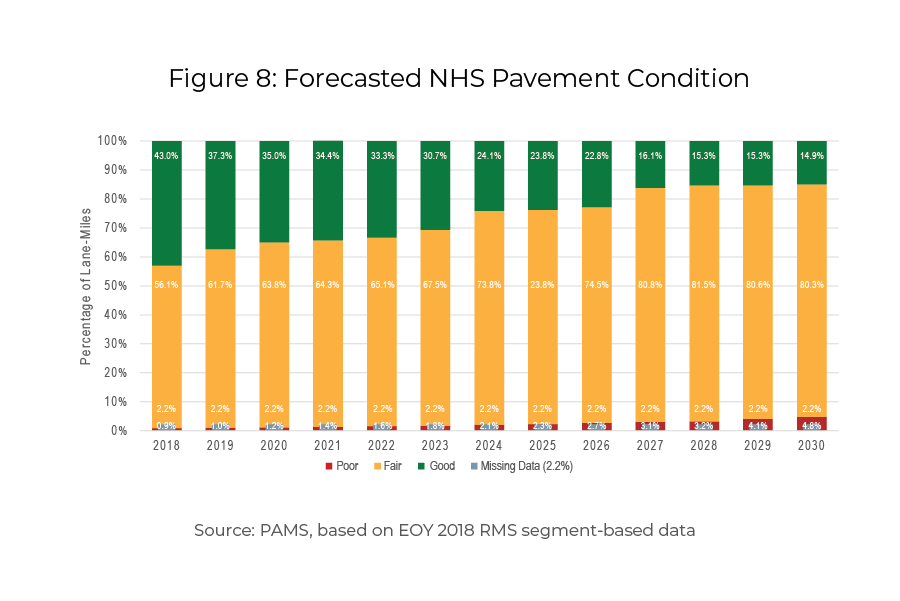

- The present funding shortfall poses a dilemma that must soon be resolved. As greatly limited resources are prioritized to the Interstate system to the greatest extent possible, other roads and bridges receive even less funding. This trade-off is untenable and unsustainable. A level of sufficient investment must be established to ensure that non-Interstate roads and bridges do not fall into an overall state of disrepair (Figure 8).

There are 22 byways throughout the state. The Brandywine Valley Byway in Delaware County received national designation in 2021 and is now one of three national scenic byways in Pennsylvania. Despite the lack of federal funding for byways initiatives, PennDOT released an updated guidance manual in 2021 and has begun work on implementing an interagency action plan for promoting the byways program. The program is envisioned to expand beyond its historically highway-only-centric focus.

Figure 8: Forecasted NHS Pavement Condition

The Figure 8 Bar Chart illustrates the forecasted National Highway System condition by the percentage of lane-miles rated by poor, fair, and good. The chart also includes a notation that 2.2% of data is missing. Data for Figure 8 is from PAMS, based on EOY 2018 RMS segment-based data.

The move toward a “lowest life-cycle cost” methodology will extend the life of Pennsylvania's bridges and pavements but will also result in an increase in the total mileage of poor pavement. Even now, pavement conditions are transitioning from good to fair as roadways deteriorate faster than they can be repaired.

Bridges

Trends & Issues

- There are more than 25,400 bridges in Pennsylvania greater than 8 feet in length, representing nearly 117 million square feet in deck area.

- As of December 2021, the number of state-owned bridges rated "poor" was just under 2,500—less than half the number of poor bridges a decade earlier. This trend reflects a focused effort by PennDOT to reduce the backlog of bridges needing repairs by using both traditional funding sources and non-traditional means, such as Public-Private Partnerships (P3s).

- The condition on average of locally owned bridges over 20 feet long is also improving, but due to the sheer number and age of local bridges needing improvement, and extreme funding constraints, this continues to be a major challenge for communities.

- Pennsylvania has made significant progress in bridge construction to reduce the number of weight-restricted bridges. Initiatives such as the Rapid Bridge Replacement Project, which replaced 558 bridges through P3s, have successfully reduced the number of these bridges.

- The percentage of poor bridges steadily increases across all lower-order business plan networks, because the structures are deteriorating faster than they can be repaired or reconstructed under current funding constraints. Given the age of Pennsylvania's bridges, barring a funding breakthrough this trend is forecasted to continue through 2030 (Figure 9).

- As mentioned in the previous section, PennDOT has organized its roadways and bridges into four Business Plan Network (BPN) classifications, including: NHS Interstate; NHS Non-Interstate; Non-NHS with ADT > 2,000; and Non-NHS with ADT < 2,000. All BPNs have less than 10 percent of bridge deck area rated poor, and bridges on non-NHS routes have larger share of deck area than NHS routes that is considered in good condition than NHS routes. More than 75 percent of Interstate deck area is fair; only 19 percent is considered good (Figure 10).

There are over 25,400 bridges in Pennsylvania greater than 8 feet in length, or nearly 117 million square feet of deck area. The average state-owned bridge is 55 years old.

Planning Implications

- The number of bridges rated poor has decreased significantly in recent years. However, there is inadequate funding to continue the “worst-first” method of prioritization. Transitioning to a "lowest life-cycle cost” approach, based project selection will help keep good bridges from becoming poor and yield additional years of service from existing poor structures, but does not address the funding need gap directly.

- The financial burden for maintaining legacy structures constructed decades ago is extensive for municipalities that are not growing, particularly rural municipalities.

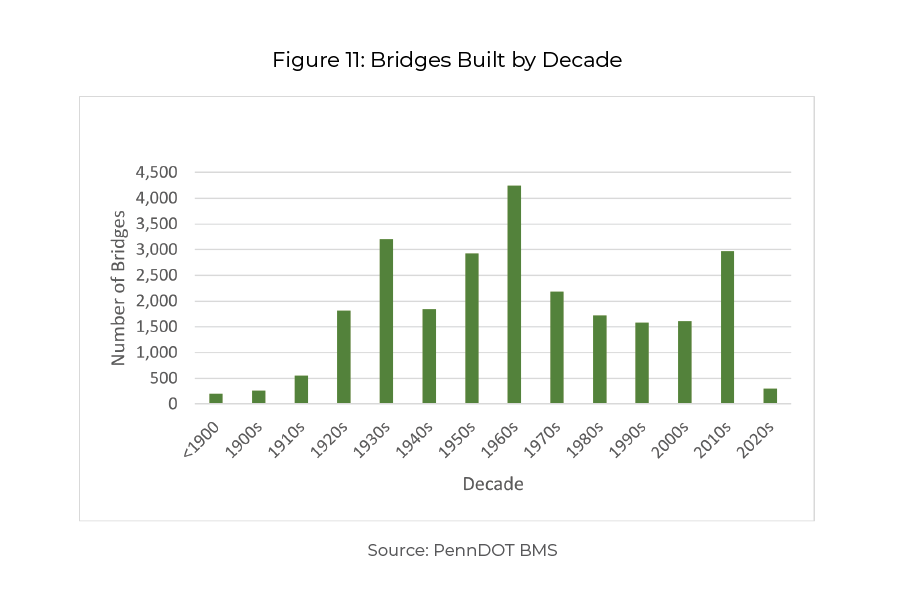

- The highest proportion of state bridges were built during the peak interstate construction period from the late 1950s through the early 1970s, but there are many older bridges still in use. A large number of bridges have also been built in more recent years (Figure 11).

Figure 9: Forecasted Poor Bridges by Business Plan Network (by Deck Area)

.png)

Figure 9, a bar chart, illustrates the percentage of forecasted poor bridges by Business Plan Network from 2019 through 2030 from PAMS, based on EOY 2018 BMS 2 data.

Figure 10: Bridge Condition by Business Plan Network

| BPN | Description | Total Count | Total Deck Area (SF) | % Good by Deck Area | % Fair by Deck Area | % Poor by Deck Area |

| 1 | NHS Interstate | 2,205 | 29,930,489 | 19% | 75% | 6% |

| 2 | NHS Non-Interstate | 4,952 | 44,243,042 | 29% | 66% | 5% |

| 3 | Non-NHS with Average Daily Traffic (ADT) ≥ 2,000 | 6,847 | 23,323,118 | 35% | 59% | 7% |

| 4 | Non-NHS with ADT < 2,000 | 11,411 | 18,402,349 | 39% | 51% | 10% |

| Source: Bridge ≥8' Data: BMS2 as of 6/30/2020 |

Figure 11: Bridges Built by Decade

Figure 11, a bar chart, depicts the number of bridges built by decade from 1900 through 2020 from PennDOT BMS data.

As the state's bridge inventory continues to age, PennDOT will be faced with a greater stock of bridges that will require increased maintenance and rehabilitation. Maintenance needs will accelerate as the bridges that were built during the 1950s and 1960s deteriorate to the point where rehabilitation or replacement is required.

PennDOT entered into agreement with some municipalities to manage local bridge bundle packages, with PennDOT handling consultant selection, design, construction, and inspection. This has helped improve local bridge conditions.

Additionally, the State Transportation Commission approved a Local Small Bridges Study report in 2021. The study included recommendations to help create increased capacity and incentives to facilitate uniformity in local small bridge (i.e., less than 20 feet in length) asset management.

Traffic Operations

Trends & Issues

- Improving transportation operations can be a cost-effective way to improve capacity and improve traffic flow. As Pennsylvania continues to operate within an increasingly constrained funding environment, there will be the need to emphasize improving operations (handling more trips on the existing system) over capacity-building (such as adding lanes and building new roads).

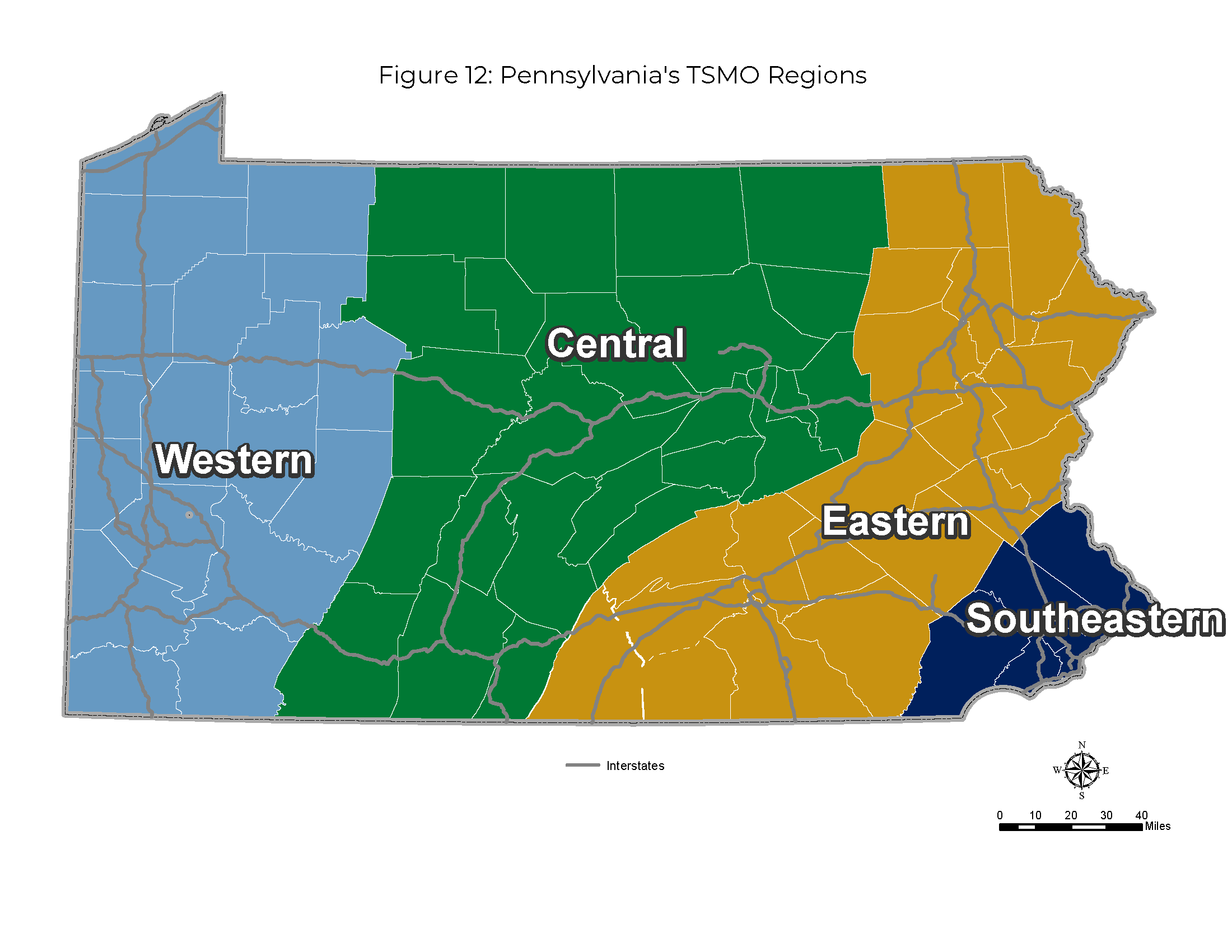

- PennDOT has developed a TSMO Program (Transportation Systems Management and Operations) (TSMO) Program that is currently being implemented. The program is designed to “advance projects and services designed to get the safest and most efficient use out of the existing and planned roadway network” (FHWA, Planning for Operations Program) and is currently implementing it. PennDOT maintains four TSMO regions (Figure 12).

- There are more than 13,800 traffic signals in Pennsylvania, which are primarily owned, maintained, and operated by more than 1,200 municipalities. Signal equipment that is properly timed and maintained helps improve travel efficiency and reduces the cost of signal operation/maintenance over time.

- Signals are permitted by PennDOT and owned by local jurisdictions; therefore, there is a disconnect between funding realities and the desire to maintain and upgrade signal systems to keep pace with new technology. Rapid changes in technology could bear positively on addressing this disconnect in the future.

- There were 18,959 traffic incidents on Pennsylvania roadways in 2019, with an average incident clearance time of 95 minutes. Both the number of incidents and the average clearance time have increased in recent years.

- PennDOT has been updating Regional Operations Plans (ROPs) for each TSMO region that identify Intelligent Transportation Systems (ITS) and operations infrastructure needs, visions, and goals. Additionally, the Commonwealth is working to establish a statewide fiber optic network that will accommodate improved ITS solutions for traffic operations.

Planning Implications

- The gains that PennDOT has achieved in recent years related to signals and ITS investments could slow or reverse based on the current funding environment. Challenging state and local funding scenarios will likely limit the ability of municipalities and PennDOT to maintain and upgrade their traffic signals and ITS devices.

- Pennsylvania can expect more commercial vehicles on the road and an increased number of trucking distribution centers. This growth will require additional accommodations such as parking areas, queueing zones, and longer traffic signal phases to account for the slower acceleration and deceleration of heavy trucks.

- Emerging technologies may significantly alter how the state's transportation system operates and is designed over the next 20 years. Some examples of emerging technology include integrated corridor management, connected ITS infrastructure, connected vehicle “platoons,” and highly autonomous and/or connected public transit and private automobiles.

- As population and industry shift in location and density across Pennsylvania, changes in land use patterns should be monitored to plan for potential shifts in transportation demand.

- With uncertainties in revenue and a decline in buying power, funding gaps for TSMO continue to widen. TSMO strategies (and planning for operations in design and construction decision-making) can help funding stretch further compared to investments in traditional capital infrastructure investments.

Figure 12: Pennsylvania's TSMO Regions

Figure 12 is PennDOT's state map of Pennsylvania illustrating the four Transportation Systems Management and Operation regions of Western, Central, Eastern, and Southeastern.

Broadband is now the modern-day form of transportation

Planning Implications (cont'd)

- There are many uses for fiber optic lines that go beyond connected and automated vehicles, e.g., access to work, school, and telemedicine for rural hospitals. The introduction of fiber can bring immediate benefits even as the technology matures and develops. Indeed, transportation and communication continue to merge in many new ways.

- An area that will be important to understand as it relates to technological advances includes curb side management. As the economy moves toward more e-commerce, the use of parking lanes and public right-of-way adjacent to businesses may change in very dynamic ways from what we are accustomed to current patterns.

- Freight movement will be heavily influenced by improvements in traffic operations and technology, as advancements will improve operating efficiencies and address operator hours hours-of-service requirements. In the future, some freight may be moved by automated vehicles for long-haul driving, with human drivers for the “first- and last-mile.” It will be easiest to accommodate automation on the Interstate system, with its highly standardized and well-maintained pavement markings and signage and more unified ownership and oversight.

There are over 13,800 Traffic Signals in Pennsylvania, which are primarily owned, maintained, and operated by over 1,200 municipalities. Enhanced traffic signal performance helps improve travel efficiency and highway safety.

Public Transportation

Trends & Issues

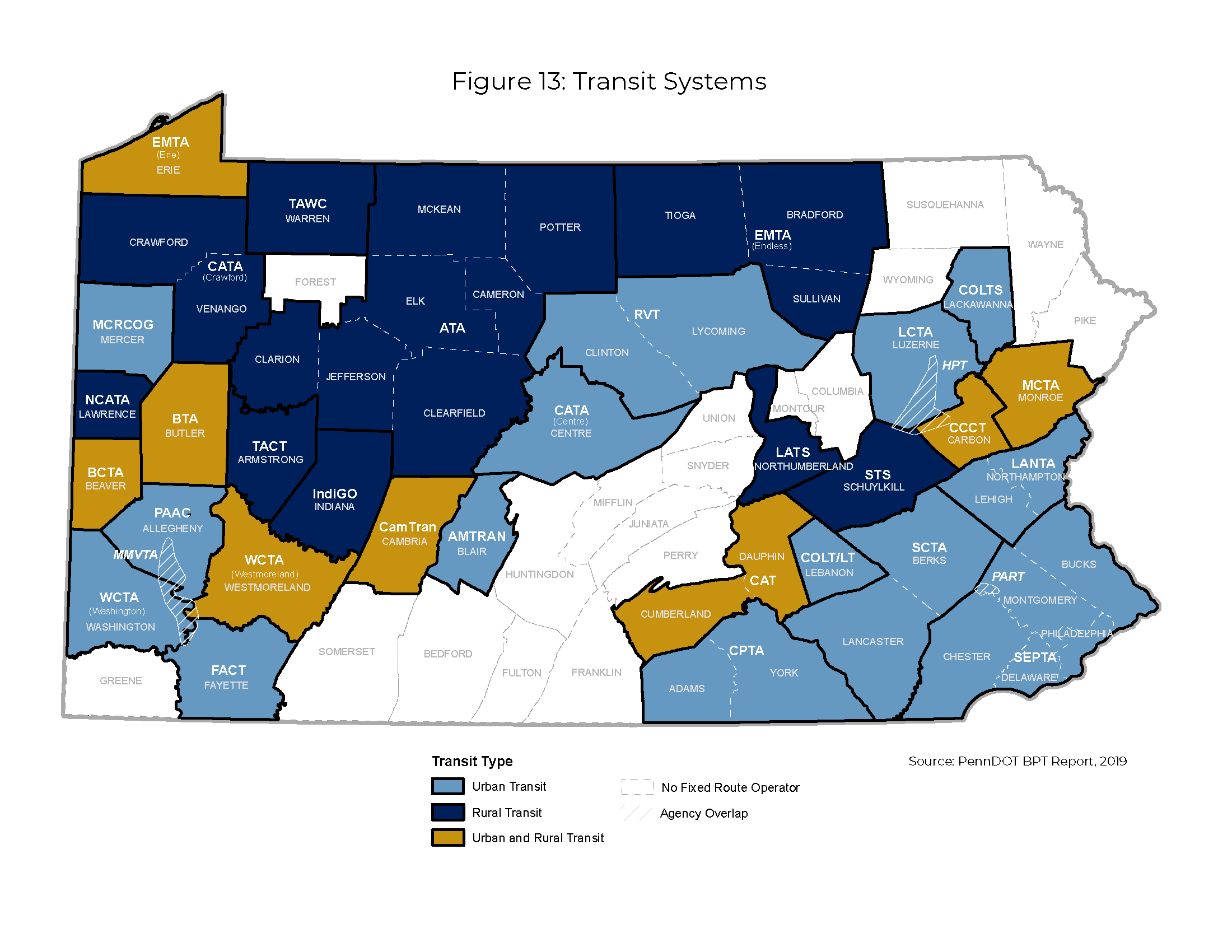

- All 67 Pennsylvania counties are served by at least one mode of public transportation, provided by 57 transit agencies (Figure 13).

- Four distinct types of services are available to transit users: fixed-route bus, shared-ride demand-response bus, intercity bus, and passenger rail. Each mode has unique operating characteristics, customer needs, and funding sources.

- Act 44 of 2007 required the Pennsylvania Turnpike Commission to make annual payments of $450 million to the Pennsylvania Public Transportation Trust Fund. Those payments will be reduced to just $50 million annually, beginning in 2022, posing a serious challenge for public transportation. It is important to note that this payment reduction would be replaced by proceeds from a Motor Vehicle Sales Tax when the annual payments end. Maintaining public transportation funding levels is vital.

- Public transportation usage across the nation has decreased in each of the last four years, even before the COVID-19 pandemic. While overall ridership in Pennsylvania has followed that trend, 15 transit agencies in Pennsylvania have experienced ridership growth. The decline in transit use could reverse in the future due to numerous factors including federal policy and changing demographics.

- PennDOT's Intercity Bus Program subsidizes a variety of services through several carriers, providing opportunities to travel into and outside of the state providing intrastate and interstate travel options (Figure 14).

- Pennsylvania's transit agencies have an annual economic impact of approximately $3.8 billion. This direct, indirect, and induced activity supports more than 32,000 jobs with $2.1 billion in employee compensation. Operating activity also generates $76 million in annual tax revenue for the Commonwealth.

- A significant portion of transit funding in Pennsylvania is provided through state-level programs and subsidies. In addition to programs like the senior shared-ride program and the Persons with Disabilities mobility program, Pennsylvania Acts 44 and 89 provide significant revenue streams for fixed-route operations and capital projects, respectively. By contrast, in other states the majority of funding for transit systems comes from local funds or federal funds. Pennsylvania's support for public transportation has been substantial.

- Act 44 of 2007 identified four performance criteria in an effort to measure the efficiency and effectiveness of transit agencies: Passengers per Revenue Vehicle-Hour (RVH), Operating Cost per RVH, Operating Revenue per RVH, and Operating Cost per Passenger. The following statewide trends have been observed, and it must first be noted that about a quarter of FY 2019-20 transit ridership was dramatically reduced by the pandemic, including the state-mandated shutdown of service. The following statistics provide the resulting statewide trends:

- Total Act 44 passenger trips decreased 22.4 percent between FY 2018-19 and FY 2019-20.

- Revenue vehicle-miles decreased 9.5 percent between FY 2018-19 and FY 2019-20.

- Overall, vehicle revenue-hours decreased 8.3 percent between FY 2018-19 and FY 2019-20.

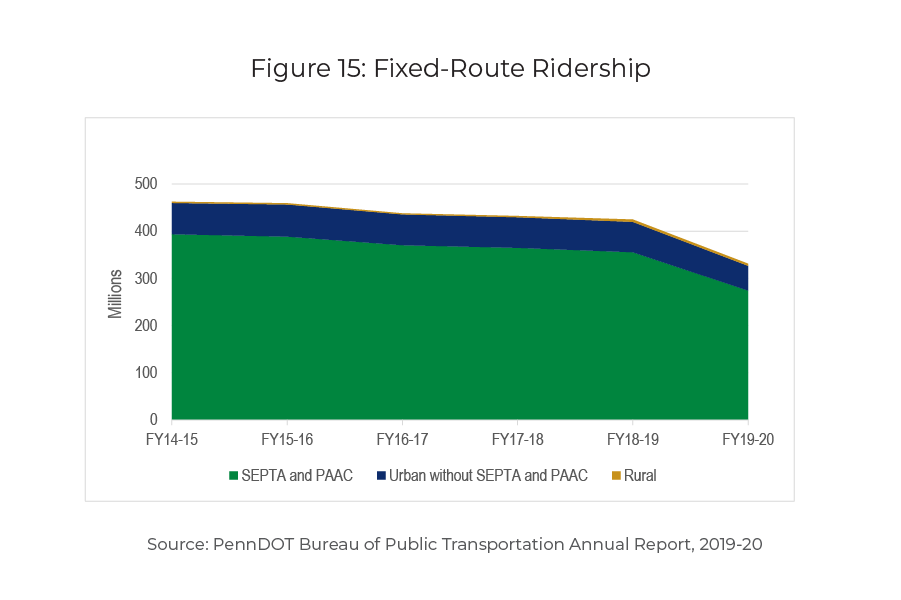

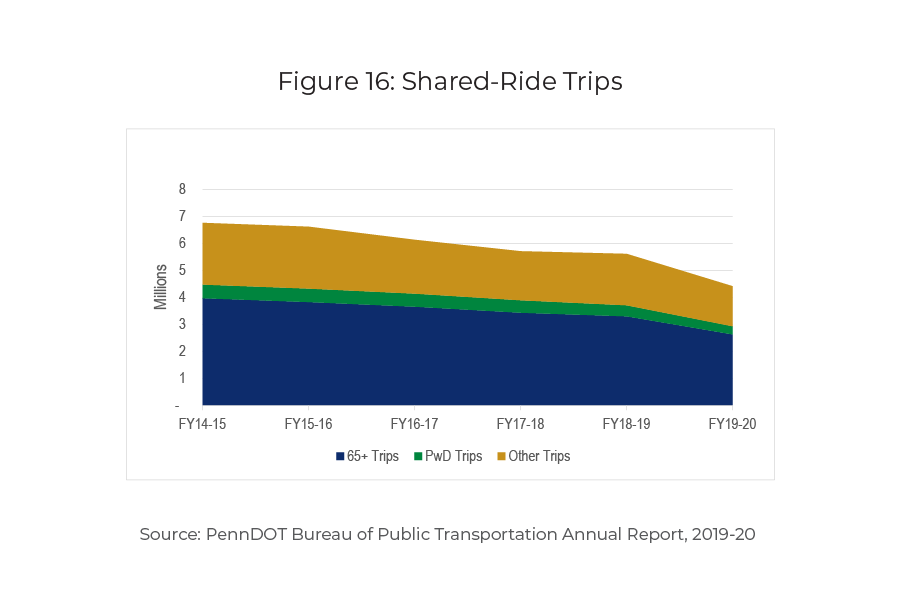

- Figures 15 and 16 provide more detail on historic ridership trends for fixed-route and shared-ride demand-response programs

Figure 13: Transit Systems

Figure 13 is PennDOT's 2019 BPT Report map of Pennsylvania depicting Pennsylvania Transit systems by Urban Transit, Rural Transit, No Fixed Route Operator and Agency Overlap by county.

Planning Implications

- The effects of the pandemic continue to significantly reduce transit ridership and increase operating costs.

- With the exception of COVID-19 federal relief funding, Federal funding for public transportation has basically been flat over the past five years as MAP-21 funding transitioned to the FAST Act funding program.

- State funding for public transportation is essential and will need to increase to help support the state's mobility needs. The July 2021 TROC proposal offers strategies to address the public transportation funding problem.

- Other planning implications for public transportation:

- Shared -ride services may be particularly difficult to sustain coming out of the pandemic, and especially so given other trends such as seniors driving longer, etc.

- Preparing for climate change initiatives is likely going to be an area that receives a great amount of attention in the near term to prepare for long-term change.

- Alternative energy sources for public transit fleet including compressed natural gas (CNG), and battery electric presents an opportunity to further promote transit while making the investments in fleet updates.

Figure 14: Intercity Bus Transportation (Subsidized Routes)

.png)

Figure 14 is PennDOT's Bureau of Public Transportation map of Pennsylvania illustrating the intercity transit routes from Erie, Pittsburgh, Harrisburg, Allentown, and Philadelphia.

Figure 15: Fixed-Route Ridership

Figure 15 is a graph illustrating the millions of fixed-route ridership for SEPTA and PAAC, Urban without SEPTA and PAAC, and Rural for Fiscal Year 2014 - 2015 through Fiscal Year 2019 - 2020 from PennDOT's Bureau of Public Transportation Annual Report, 2019-20.

With over 300 million trips taken in Fiscal Year (FY) 2019-20, fixed-route urban transit represents the majority of the passenger trips provided in Pennsylvania each year (Figure 15). The overwhelming majority (91 percent) of these trips are provided by the two largest transit agencies, the Southeastern Pennsylvania Transit Authority (SEPTA) serving the Philadelphia region, and Port Authority of Allegheny County (PAAC) in Pittsburgh.

Figure 16: Shared-Ride Trips

Figure 16 is a graph illustrating the millions of shared-ride trips by riders 65+, Persons with Disabilities and other trips from Fiscal Year 2014 - 2015 through Fiscal Year 2019 - 2020 from PennDOT's Bureau of Public Transportation Annual Report, 2019-20.

Pennsylvania has one of the most comprehensive coordinated shared-ride demand-response programs in the nation. During the four-year period ending FY 2018-19, coordinated shared-ride trips declined by nearly 1.1 million (Figure 16). This loss can be primarily attributed to seniors continuing to drive into older age than in the past.

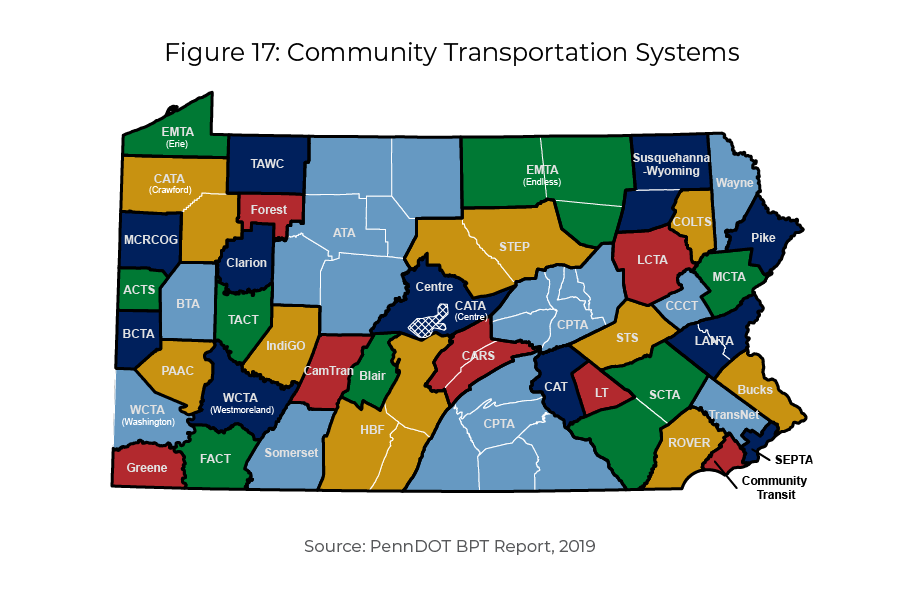

Figure 17: Community Transportation Systems

Figure 17 is a Pennsylvania state county map depicting the community transportation systems that serve each county from the 2019 PennDOT BPT Report.

With over 300 million trips taken in FY19-20, fixed-route urban transit represents the majority of the passenger trips provided in Pennsylvania each year, and most of these trips (91%) are provided by the Southeastern Pennsylvania Transit Authority (SEPTA), and Port Authority of Allegheny County (PAAC).

Passenger Rail

Trends & Issues

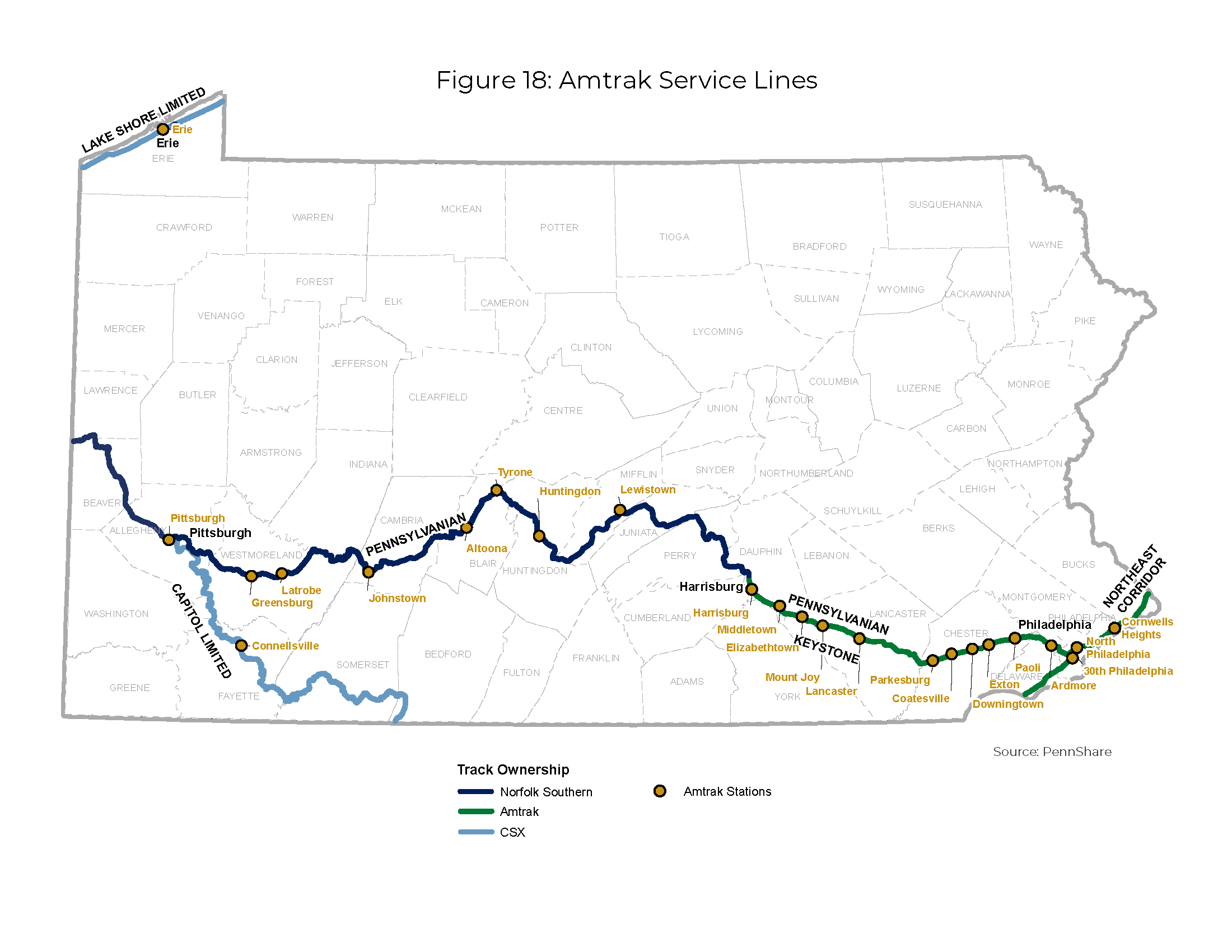

- Intercity passenger rail service in Pennsylvania is primarily provided by the National Railroad Passenger Corporation, known as Amtrak. Amtrak operates 13 service lines on five corridors in Pennsylvania that range from high-speed service along the Amtrak-owned Northeast Corridor (NEC) to daily long-distance service along the Capitol Limited route through the southwestern corner of the state (Figure 18). There have been extensive efforts to increase passenger rail service between Harrisburg and Pittsburgh.

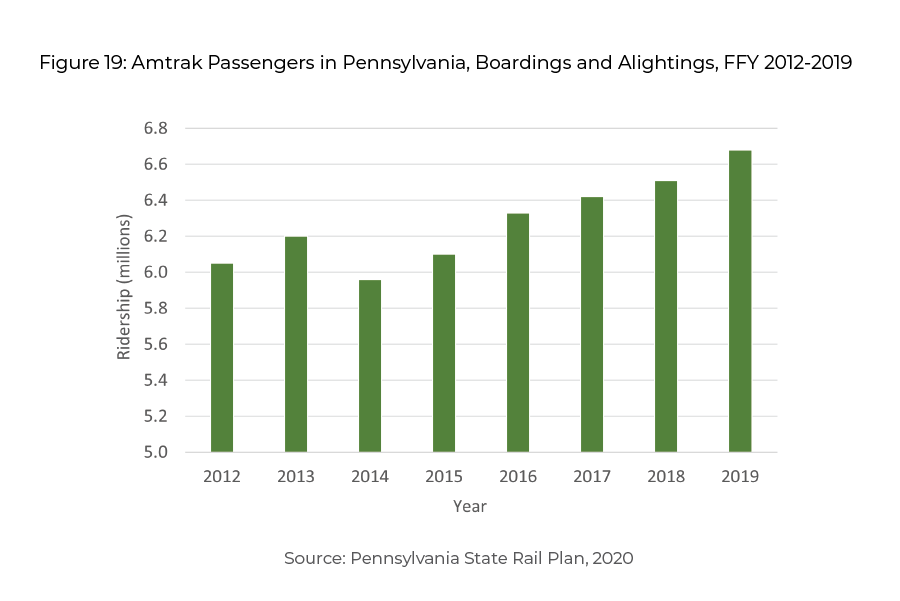

- Total boardings and alightings (exits at the destination) for Amtrak's 24 Pennsylvania stations for Federal Fiscal Year (FFY) 2019 were 6.67 million (Figure 19). Ridership originating in Pennsylvania has increased by more than 700,000 trips over the past five years. These trends are expected to continue across all Pennsylvania Amtrak stations as ridership is projected to grow by 1.4 million (21 percent), climbing from 6.7 million in FFY 2019 to 8.1 million in FFY 2025.

- Additionally, the Southeastern Pennsylvania Transportation Authority (SEPTA) Regional Rail system, and NJ Transit's Atlantic City Line provide regional commuter rail services among communities in the Philadelphia metropolitan region and between Atlantic City and Philadelphia, respectively.

- The SEPTA Regional Rail system offers commuter rail service in the five-county Philadelphia region (in addition to Trenton, NJ; West Trenton, NJ; Newark, DE; and Wilmington, DE), operating 13 service lines across 280 route-miles. In FY 2019, SEPTA reported an annual Regional Rail ridership of 34,190,970 (a decrease of 0.5 percent from FY 2018) and average weekday regional rail ridership of 119,000. Port Authority of Allegheny County (PAAC) also provides light rail services to areas surrounding the City of Pittsburgh within Allegheny County.

- According to ridership projections prepared by the Delaware Valley Regional Planning Commission (DVRPC), the SEPTA Regional Rail network is projected to grow by 8,730 person-trips (7.3 percent) and by 9,176 passenger-miles (5.2 percent) from 2020 to 2045. Funding for improvements to accommodate the projected growth will be critically important for users, traffic congestion, and environmental reasons.

- Both Amtrak's and SEPTA's major stations facilitate intermodal connections with local bus and light rail transit options. Amtrak has operating agreements with commuter (SEPTA and NJ Transit) and freight (CSX and Norfolk Southern) rail operators throughout Pennsylvania for shared use of rail infrastructure.

- Ridership demand declined by nearly 30 percent during FY 2019-20 due to the COVID-19 pandemic. Amtrak's Keystone Service between Harrisburg and New York via Philadelphia was suspended for several weeks as a pandemic public safety measure. Ridership on SEPTA's Regional Rail decreased dramatically due to the pandemic. As of August 2021, Regional Rail ridership was approximately 20 percent less of where it was, pre-pandemic.

More than 4.5 million Amtrak passengers used Philadelphia's 30th Street Station in FFY 2019, making it thethird-busiest Amtrak station in the countryafter Penn Station in New York City and Union Station in Washington, D.C. Stations in Lancaster and Harrisburg each served more than 500,000 passengers.

Figure 18: Amtrak Service Lines

Figure 18 is PennShare's Pennsylvania state map illustrating Amtrack Service Lines and track ownership by Norfolk Southern, Amtrak, and CSX. In addition, the map includes the locations of Amtrak Stations.

Planning Implications

- Population growth across the nation is concentrating in urban areas of all sizes, not just the largest metro areas. This growth encompasses people of all ages who have not demonstrated higher rates of ridesharing and lower vehicle ownership rates, yet may choose passenger rail for their intercity travel needs. Agencies such as SEPTA and the Port Authority of Allegheny County (PAAC) will need to be responsive to this growing customer base to remain viable. The July 2021 Transportation Revenue Options Commission strategic funding proposal includes potential revenue sources that can expand public transportation funding.

https://www.penndot.gov/about-us/funding/Pages/TROC.aspx

- Higher-density, mixed-use development associated with transit systems (i.e., transit-oriented development), has been a focus of community and economic development planning in Pennsylvania's small- to mid-size rail-served urban areas, though it is far outpaced by low-density, auto-dependent residential development at the edge of existing development. In order to control costs, address climate change, and manage growth responsibly, there should be more high density and active transportation-suited development, as well as infill development within existing low-density areas for greater efficiency.

- The State Rail Plan identifies an investment of capital projects totaling $4.5 billion between 2021 and 2045. In addition, there are $1.0 billion worth of “vision projects” for which implementation dates are yet to be determined.

- The future COVID-related impacts on commuting and travel patterns are not fully known but will need to be considered as program planning and delivery become ever more dynamic.

- A 2019 Transportation Advisory Committee study on intercity rail can provide a useful baseline or starting point for any reexamination of potential future service—particularly in light of the potential for more federal investment in intercity passenger rail.

Figure 19: Amtrak Passengers in Pennsylvania, Boardings and Alightings, FFY 2012–2019

Figure 19 is a bar chart from the 2020 Pennsylvania State Rail Plan Bar chart illustrating Amtrack passenger ridership by the millions from Federal Fiscal Year 2012 through 2019.

The Delaware Valley Regional Planning Commission (DVRPC) projects that the SEPTA Regional Rail network with grow by 8,730 person trips (7.3 percent) and by 9,176 passenger miles (5.2 percent) from 2020 to 2045.

Active Transportation

Trends & Issues

- Active Transportation is any self-propelled, human-powered mode of transportation, (such as walking and/or bicycling). Use of the term “active transportation' highlights the growing recognition of the connection between public health outcomes and transportation planning.

- PennDOT's Active Transportation Plan outlines a vision and framework for improving conditions for walking and bicycling across Pennsylvania, most notably for those who walk and bicycle out of necessity rather than for leisure and recreation. Pennsylvania's active transportation network and recreation spaces link communities, connect children to the outdoors, and serve as economic engines for small towns and big cities looking to attract tourists. Improved and expanded bicycle and pedestrian facilities also support improved community health outcomes and ensure flexibility and resiliency in the face of climate change.

- The COVID-19 pandemic highlighted the value of our non-motorized transportation network. Communities statewide experienced an increased need for safer and more accessible walking and bicycling infrastructure as more Pennsylvanians began walking and bicycling to parks, trails, grocery stores and other community resources.

- According to the Pennsylvania Environmental Council, when tracking the use of 67 trails, parks, and natural areas around the state, activity spiked by as much as 200 percent during March and April 2020 over the same period a year earlier. Demand remains elevated with many new users inclined to continue with greater levels of physical activity.

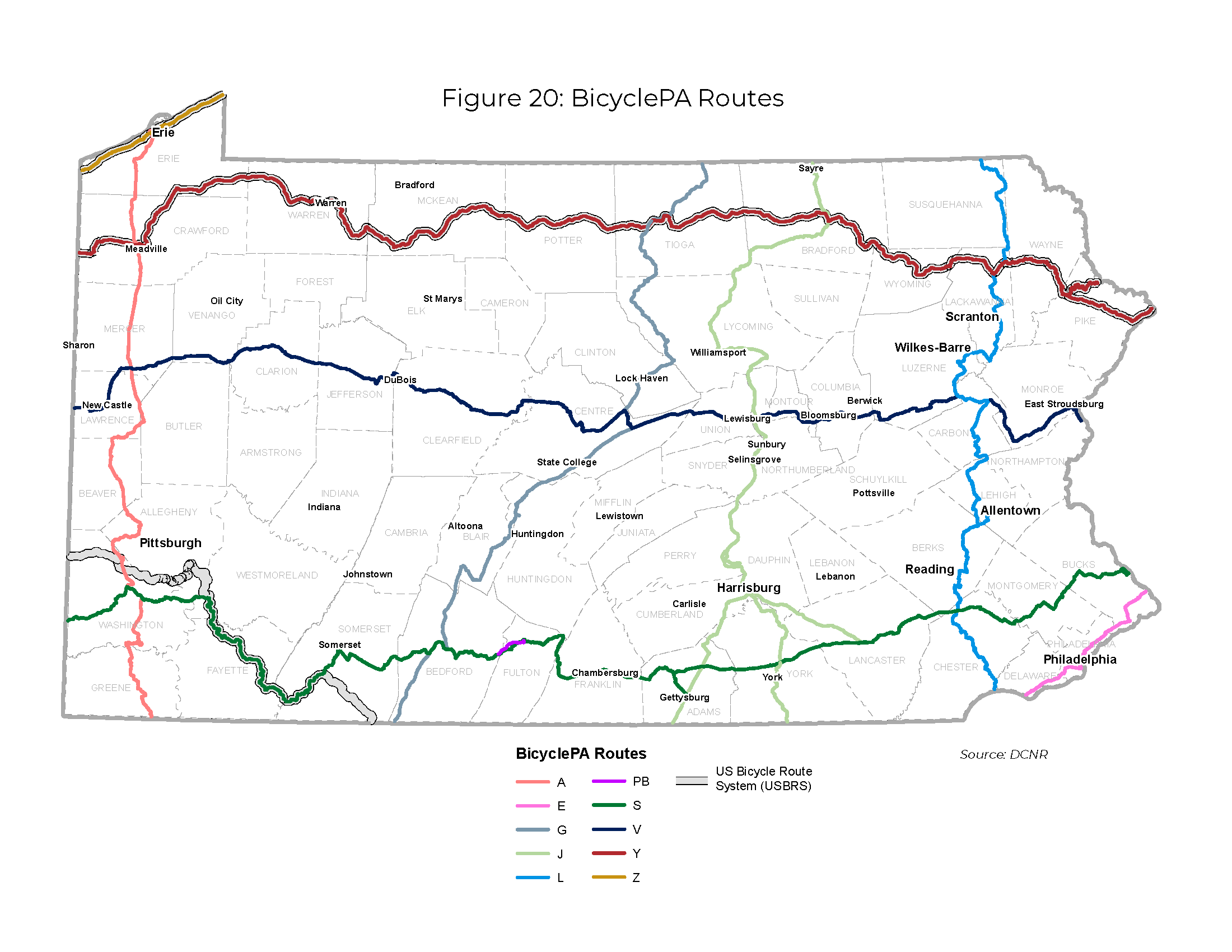

- The Commonwealth has 11 BicyclePA routes (Figure 20). Pennsylvania's first nationally designated bicycle route, U.S. Bicycle Route 50, is a 163-mile bicycle route designated in May 2017.

- Results from a 2018 public survey for PennDOT's Active Transportation Plan showed that 30 percent of respondents found it “challenging” or “very challenging” to walk in their community, while 58 percent found it challenging or very challenging to ride a bicycle in their community. Additionally, most respondents indicated that physical infrastructure such as separated bicycle lanes, sidewalks, and a connected non-motorized network was needed for them to consider walking or bicycling more frequently.

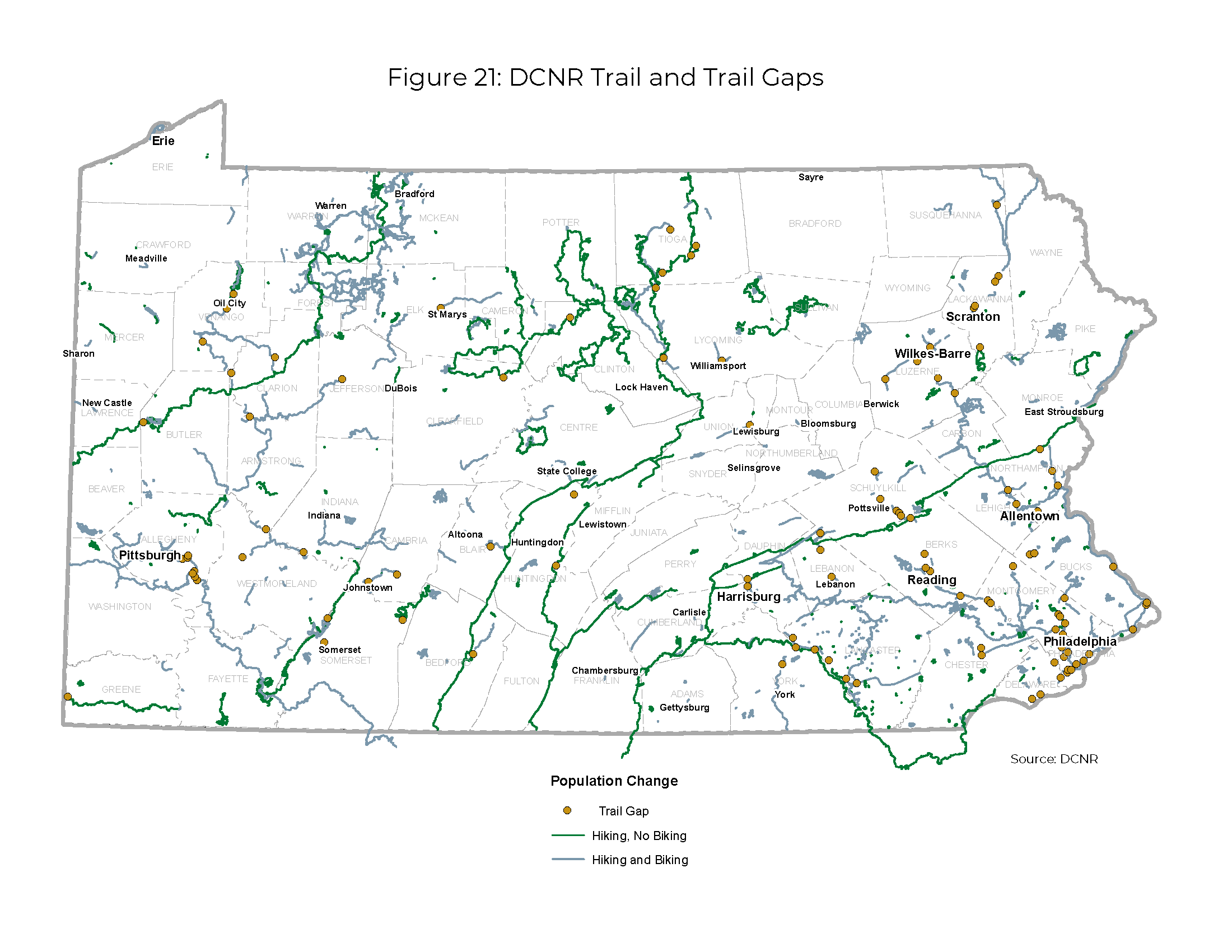

- Funding opportunities for trail planning and development have increased significantly. Between 2009 and 2014 the Pennsylvania Department of Conservation and Natural Resources (DCNR) awarded $45.6 million for 317 trail projects. In 2018 the agency funded the completion of one of the state's major trail gaps, 16.8 miles of new non-motorized trails, 22 miles of rehabilitated trail, and planning for another 7.4 miles of future trails. Trails and gaps are mapped on Figure 21.

- Funding opportunities are also available through the Multimodal Transportation Fund and the Transportation Alternatives Set-Aside Program—new sources that are being used extensively by municipalities and other eligible sponsors to improve walking and bicycling accommodation.

Planning Implications

- PennDOT and its state, regional, and local partners must coordinate efforts and leverage existing and new resources to improve the current policies, legislation, funding, and infrastructure intended to support active transportation.

- Public health and public interest will continue to translate into growing support for investments that expand active transportation.

- There are numerous plans and programs being undertaken at the county and municipal levels that are increasing the public's access to facilities and activities focused on active transportation. Growing public support is a key factor in future planning and investment decision-making.

Figure 20: BicyclePA Routes

Figure 20 is PennDOT's map of Pennsylvania depicting the BicyclePA Routes of A, E, G, J, L, PB, S, V, Y, Z and the US Bicycle Route System.

Figure 21: DCNR Trails and Trail Gaps

Figure 21 is a DCNR map of Pennsylvania illustrating DCNR Trails with hiking and no biking, hiking and biking allowed and trail gaps.

PennDOT's 2019 Active Transportation Plan outlines a vision and framework for improving conditions for walking and bicycling across Pennsylvania, most notably for those who walk and bicycle out of necessity rather than for leisure and recreation.

Aviation

Trends & Issues

- There are approximately 655 aviation facilities across Pennsylvania. These include 123 licensed public-use airports, including three heliports and two seaplane bases, as well as 230 private-use airports and 282 private-use heliports.

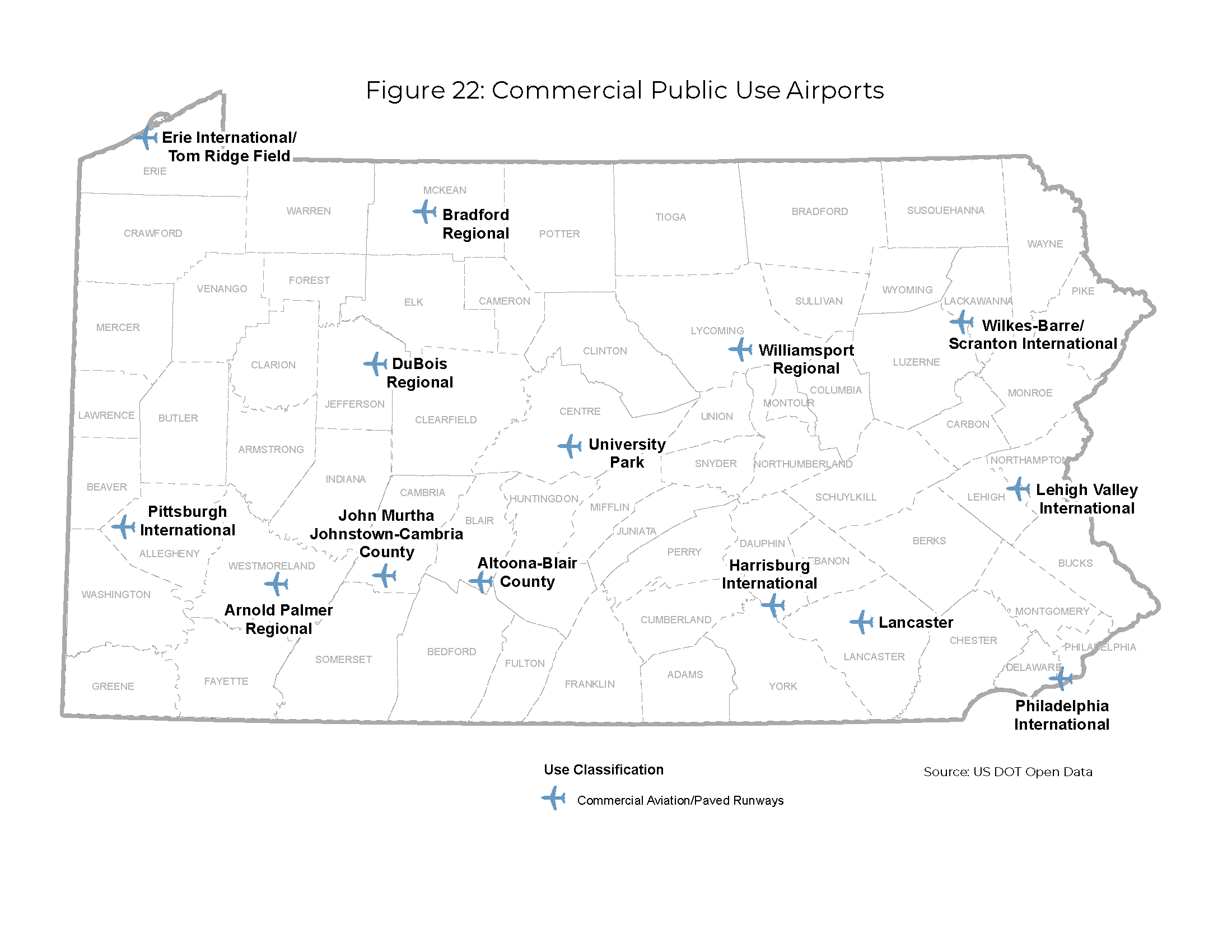

- Of the public-use airports, 14 are commercial service airports (Figure 22), which are also used for air freight; the remaining 113 are general aviation airports offering on-demand air transportation service.

- According to the 2019 Interim Aviation Economic Impact Study, Pennsylvania's commercial and general aviation airports provide an annual economic impact of $28.5 billion to the state. As would be expected, the state's 15 commercial airports generate most of the economic activity, at approximately $26.7 billion (Figure 23).

- In 2018, there were 21.7 million air carrier enplanements in Pennsylvania—a 10-year increase of 0.9 percent.

- The COVID-19 pandemic has had both a public health and economic impact, drastically reducing air travel operations in 2020. The full impact and recovery timeline of this public health emergency is not yet known, though it may be longer than previous recoveries due to its worldwide impact.

- Although forecasts indicate a rise in based aircraft and operations, there is sufficient capacity system-wide to accommodate future growth.

- Of the three factors that have influenced statewide airport operations and development, namely increasing fuel costs, protection of airspace and runway approaches, and community disposition toward airport development, PennDOT's Bureau of Aviation has been active in promoting airport hazard zoning to protect airspace. A 2020 review of Pennsylvania Bureau of Aviation data found that compliance has increased to 47 percent of affected municipalities.

- Air cargo revenue ton-miles increased both domestically and internationally between 2009 and 2019, by 36.5 percent and 105.5 percent, respectively.

Planning Implications

- With estimates of a near-doubling of passenger and cargo numbers by 2036, airport infrastructure improvements are needed, and can be expected to support airport job growth.

- Regarding commercial activity, Philadelphia International Airport (PHL) could face major operational challenges. While the introduction of larger aircraft may result in the consolidation of flight schedules, the airport's airspace remains congested. General aviation and reliever airports in southeastern Pennsylvania help reduce congestion in and around the PHL airspace and minimize delays for non-commercial activity.

- Three constrained general aviation service airports—Doylestown, Heritage Field, and Brandywine—should be upgraded where possible to continue meeting regional demand, especially because aircraft operations in Eastern Pennsylvania are forecasted to grow faster than the state's average.

There is a strong relationship between enplanements and the economy. The economic downturn of the early 2000s following September 11, 2001, and the Great Recession of 2007-09 had a profound effect on the level of air traffic in the U.S. The pandemic also greatly reduced enplanements.

Figure 22: Commercial Public-Use Airports

Figure 22 is a U.S. DOT Open Data map of Pennsylvania showing the 14 Commercial Aviation/Paved Runway airports across the state.

Figure 23: Economic Impact of Commercial Airports in Pennsylvania, 2019

| Airport | Economic Impact, 2019 | Percent of Total |

| Philadelphia International Airport | $16,561,963,000 | 62.0% |

| Pittsburgh International Airport | $7,011,038,532 | 26.2% |

| Harrisburg International Airport | $1,017,571,000 | 3.8% |

| Lehigh Valley International Airport | $547,725,000 | 2.1% |

| Wilkes-Barre/Scranton International Airport | $452,138,000 | 1.7% |

| All other commercial airports | $1,126,827,000 | 4.2% |

| Total Estimated Economic Impact | $26,717,262,532 | 100.0% |

| Source: PennDOT Bureau of Aviation – Economic Impact of Aviation in Pennsylvania Report (2019 Interim Update) |

There are approximately 655 Aviation Facilities across Pennsylvania. These include 128 licensed public-use airports, including three heliports and two seaplane bases, as well as 243 private-use airports and 284 private-use heliports.

Connected and Automated Vehicles (CAV) and Technology

Trends & Issues

- There are many initiatives currently underway that aim to prepare for the introduction of Connected and Automated Vehicles (CAVs) to the U.S. and Pennsylvania's roadways. These initiatives include research and testing of Highly Automated Vehicles (HAVs), public outreach and education, and developing legislation to govern the safe operation of these vehicles.

- PennDOT is responsible for many CAV initiatives and is a leader in the national effort to develop standards and practices through its participation in multiple USDOT and national committees, and through initiatives such as PennSTART, the Statewide Connected and Automated Vehicle Strategic Plan, and the Smart Belt Coalition.

- In addition to personal vehicles, other roadway user types such as freight haulers are rapidly transitioning to a more automated fleet of vehicles. The freight sector is likely to be the earliest adopter of the technology due to the cost savings and driver shortages. As a national hub for freight movement, improvements in freight transportation will be directly beneficial to the Commonwealth.

- Pennsylvania's first automated vehicle legislation, Act 117 of 2018, allows for the platooning of up to three vehicles on public roadways. Platooning could potentially increase the amount of freight moved by a single driver by enabling the driver to operate a fleet of up to three trucks, buses, or military vehicles.

- In addition to managing the research and testing of HAV technology, PennDOT has also convened three PA Autonomous Vehicle Summits to explore the future potential of automated vehicles.

- Beyond CAV, PennDOT has been recognized for other technological advances through awards such as the operational excellence award for the Automated Work Zone Speed Enforcement and the best use of technology award for the Shaler Street Bridge Replacement in Pittsburgh.

Planning Implications

- An increase in new technologies on roadways will change physical aspects of the nation's transportation network and operations such as traffic patterns, land use, travel volumes, curbside management, use hours of vehicles, and roadway design. Future PennDOT guidelines and publications will need to accommodate these changes.

- The Pennsylvania Automated Vehicle Strategic Plan (2018) outlines four pilot projects that are advantageous to implement in the near term to assist with the shift toward automation. These pilots will need to be implemented to better help identify understand the changes that will be needed to adapt the current transportation system to a more automated future.

- A number of potential challenges emerge as widespread implementation of new technologies could completely change traffic infrastructure needs and traffic patterns. Some challenges include significant funding needs, ownership and maintenance, timing of implementation, and accessibility.

As of November 2021, there is no legislation allowing autonomous vehicles to operate on PennDOT roadways. However, PennDOT has produced guidance for vehicle testers to safely experiment with their products with a human driver behind the wheel. Development of legislation can be a long process that can impede implementation of new technologies

Freight Rail

Trends & Issues

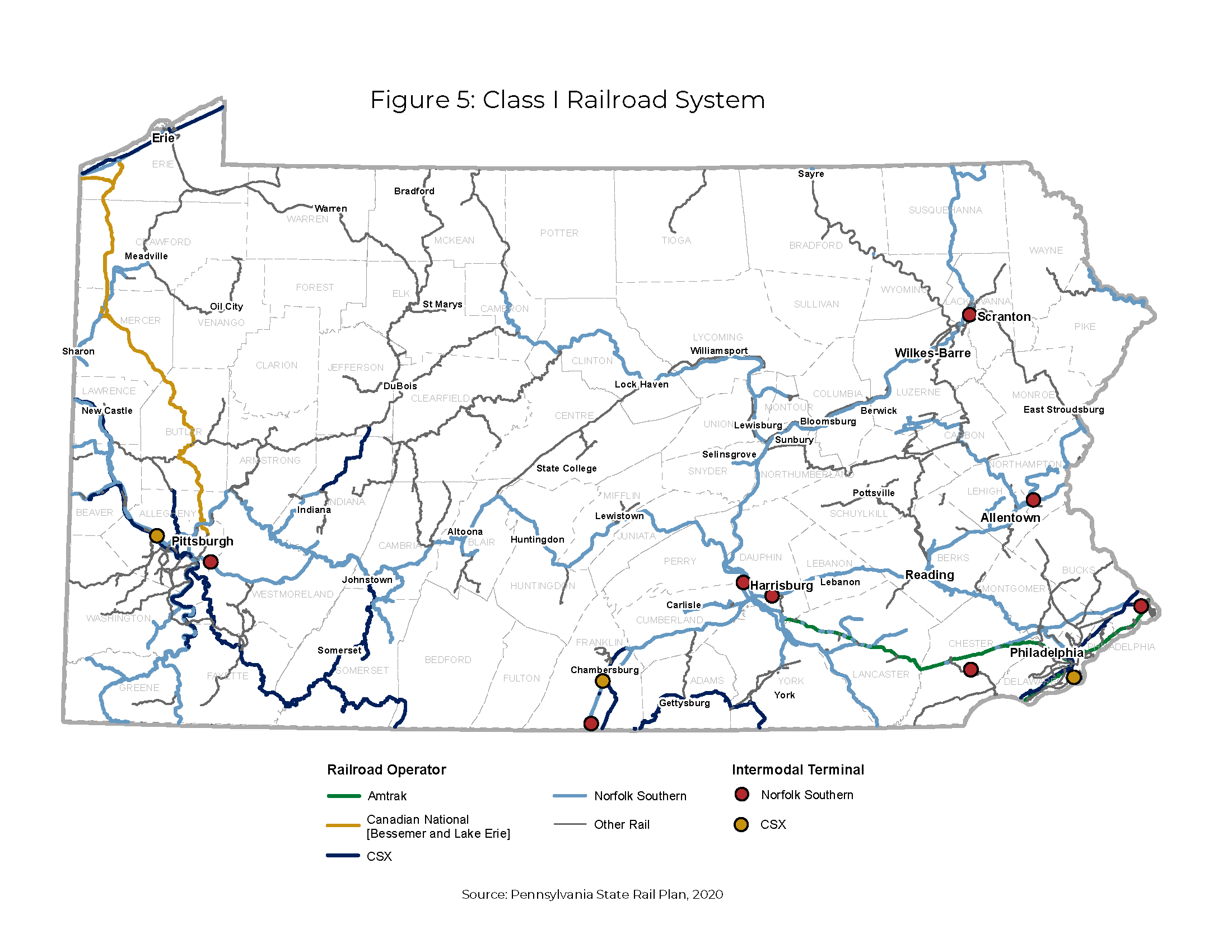

- Freight Rail Pennsylvania's freight railroad activity ranks among the leaders across the U.S. by several measures, including the number of railroad companies operating in the state, track mileage, tonnage, car loadings, employment, and total compensation for railroad employees and retirees.

- While freight rail is primarily a private sector transport mode, the public benefits are considerable and have been the basis for state investment for a long time. Chief among these benefits is the reduction of highway and bridge demand with mode shift to rail.

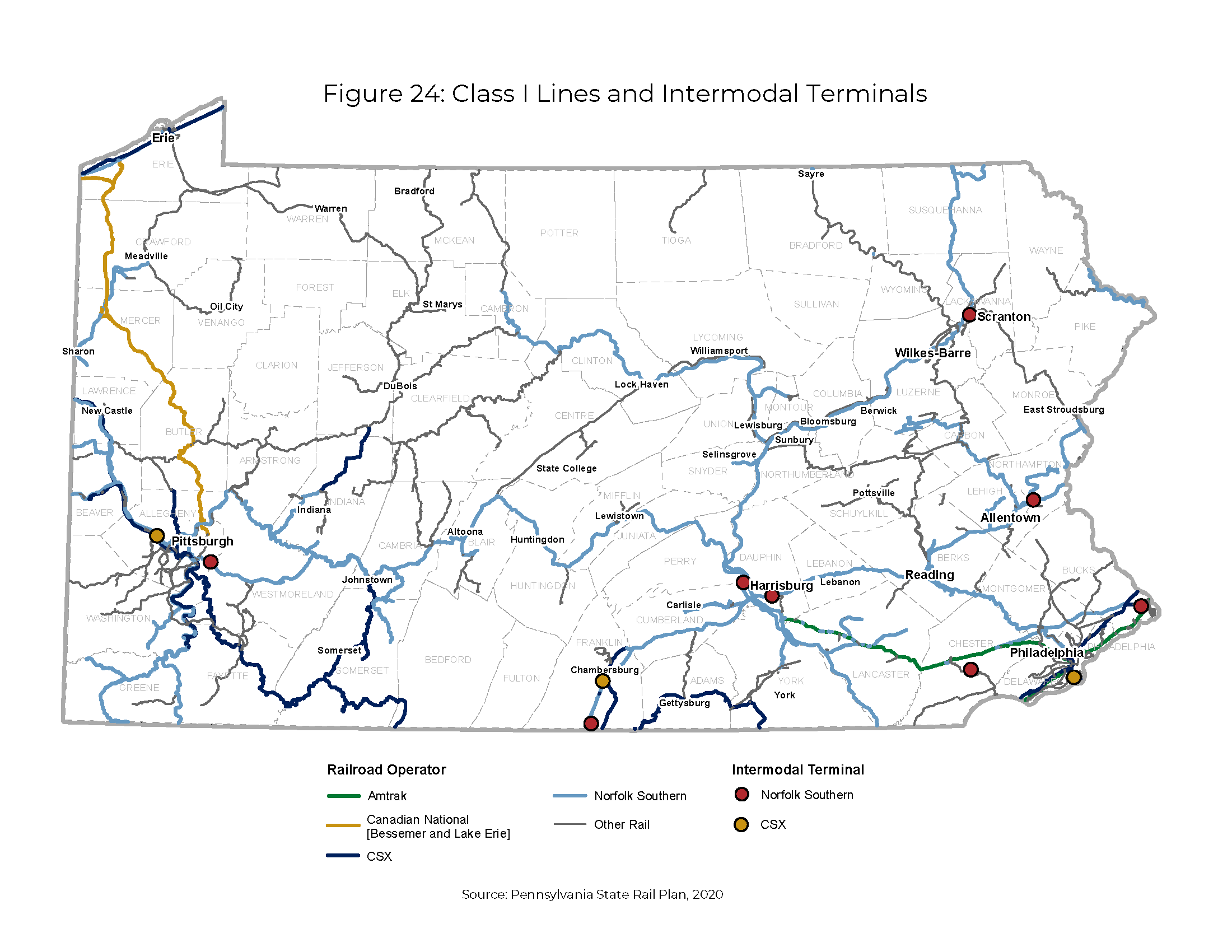

- The Pennsylvania freight rail system comprises three general categories established by the Federal Railroad Administration (FRA). These include:

- Three Class I railroads, comprising 47 percent of the route-miles in Pennsylvania

- Three regional (Class II) railroads, with 14 percent of the route-miles

- 57 short-line (Class III) railroads, including local (29 percent of the route-miles) and terminal/switching railroads (10 percent of the route-miles)

- One of the unique elements of the Pennsylvania freight rail network is the Conrail Shared Assets system. After the acquisition of Conrail by Norfolk Southern and CSX in the late 1990s, a remnant of Conrail remained as a switching and terminal railroad in several regions of the Northeast. The railroad is jointly owned by CSX and NS, and in Pennsylvania it operates on more than 65 miles of right-of-way in the Philadelphia area.

- USDOT projects long-term (2018-2045) growth in rail freight in Pennsylvania of 36 percent in tonnage, 23 percent in ton-miles and 129 percent in value. These figures indicate a long-term pattern of growth in activity on Pennsylvania's freight rail system. However, with the exception of the increase in the value of commodities moved by rail, the growth pattern reflected by these USDOT projections is indicative of slower growth in rail freight volumes than in trucking activity.

- Some of the major Class I rail lines in Pennsylvania are used jointly by freight and passenger trains. This shared use of right-of-way presents operational capacity and safety concerns for current and future rail service.

- Highway–railroad grade crossing safety has been a major national railroad safety priority over the years. The 2020 State Rail Plan (SRP) indicates that there are more than 3,500 public grade crossings in Pennsylvania. The Commonwealth has made the elimination of grade crossings (where feasible) a major initiative through the Railway–Highway Grade Crossing (Section 130) Program.

- The Pennsylvania freight railroad network is shown in Figure 24.

Figure 24: Class I Lines and Intermodal Terminals